When purchasing a house, many people rely on a home loan to finance the purchase. The interest rate is one of the key factors that determine the cost of the loan. If you’re paying a high-interest rate on your home loan, you may consider a home loan balance transfer. A home loan balance transfer is …

Home loan balance transfer is a prevalent option among borrowers seeking to secure better terms on their home loan. This involves moving the existing loan balance to a new lender who offers lower interest rates or more favorable terms and conditions. In this discourse, we shall examine the benefits of home loan balance transfer and …

If you are interested in saving money on your home loan repayments, one potential method is to switch to a new lender via a home loan balance transfer. This involves transferring your existing home loan to a new lender with a lower interest rate. However, there are a few factors to consider before you make …

A home loan balance transfer is the means of transferring an existing home loan to another lender at a lower interest rate and other benefits. It is very similar to a new home loan. When a borrower makes a balance transfer, their entire outstanding balance is transferred to the new account, where the new lender …

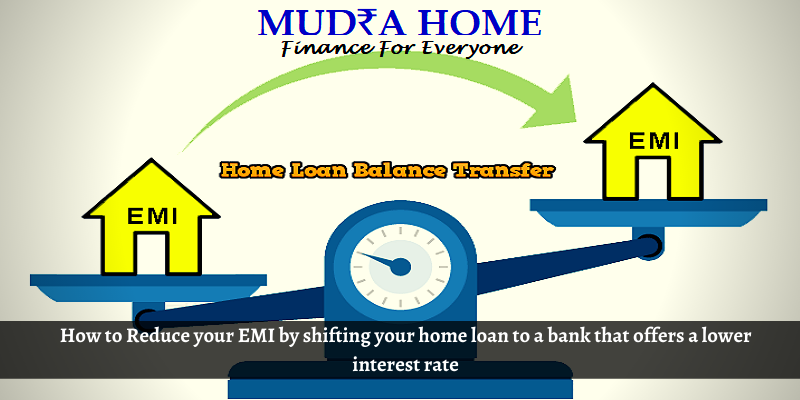

Homebuyers will have many options to choose from this holiday season. Property developers are offering discounts, some state governments have lowered stamp taxes, and banks are competing for lower interest rates. Interest rates have been the lowest in 15 years. For example, Kotak Mahindra Bank offers mortgage rates starting at 6.75%, while Bank of Baroda …

![Home Loan Balance Transfer-[A]](https://blog.mudrahome.com/wp-content/uploads/2020/07/Home-Loan-Balance-Transfer-A.png)

Mortgage loan transfer helps you lower your EMI by transferring your current loan from other financial institutions to an institution that offers a lower interest rate. Transferring or refinancing the mortgage loan or directly transferring the credit is the process by which you can benefit from the lower interest rate of the other lender. If …

A Home loan is the best example of a good credit. A home loan makes you a proud property owner once the loan repayment is cleared. Moreover, the capital appreciation on the house is much more than what one invests. Though a home loan runs for a long period of time yet, the loan borrower …

With the current fluctuation and competitive market all the Banks/ NBFC’s try to acquire and retain new and existing customers with the best available market interest rates. After borrowing and successfully running a home loan for few years, we at times look for better alternatives to reduce the EMI or interest rates or other terms …