Wondering for right home loan for your dream home? Let ‘ghar ki laxmi’ have it for you.

Yes, your curiosity stands right on thinking, how? It’s just about your awareness of the home loan benefits women enjoy in India.

In today’s world women have become independent and aware in making financial decisions, government of India too have successfully implemented policy to encourage women empowerment and ensure financial inclusion of women in all spheres.

Buying a dream home is a life time decision and becomes difficult with increasing expenses of daily life. Though in the past few years buying home has become quite easy due to home loan facility. Home loan gives a flexibility to finance your dream house with your comfortable repayment capacity. In your search of your dream home, you invariably hunt for a home loan which can be availed for as long as 20-30 years and since the loan tenure is so long, the final cost can end up being very high. The reduction automatically follows in the case of a woman borrower. So, let’s walk through the benefits that Indian women, our ‘ ghar ki laxmi’, borrowers can accumulate in the case of a home loan. She can be a main applicant or a co-applicant to avail these benefits.

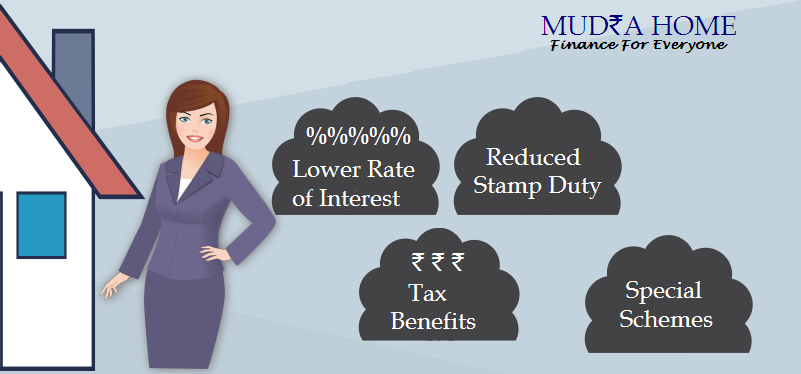

The interest rate is the key to a cost-friendly home loan as they are invariably in large amounts for a longer duration. During a long run even a slight difference in the interest rate can reduce the flow of interest outgo substantially in a period of 20-30 years and hence the pinch on your pocket is also reduced. Additionally, the monthly instalment will also come down. Most of the bank in India offers a concession of 0.05% to 1% in the interest rate to a women borrower. This seems a small concession but proves to be a big relief in long term and gives a significant amount as saving. To facilitate your home loan with such benefits women has to be a part of your home loan either as a borrower or a co-borrower.

The interest rate is the key to a cost-friendly home loan as they are invariably in large amounts for a longer duration. During a long run even a slight difference in the interest rate can reduce the flow of interest outgo substantially in a period of 20-30 years and hence the pinch on your pocket is also reduced. Additionally, the monthly instalment will also come down. Most of the bank in India offers a concession of 0.05% to 1% in the interest rate to a women borrower. This seems a small concession but proves to be a big relief in long term and gives a significant amount as saving. To facilitate your home loan with such benefits women has to be a part of your home loan either as a borrower or a co-borrower.

Property comes with another cost – Stamp duty. And indeed a difference of a few percentage can make a huge difference in the home ownership cost. Home loan is financed at about 80%-90% of the property cost and sometimes even 100% depending from case to case. The percentage of stamp duty varies from one state to another. Alike interest rate, women borrower here also gets a concession of 1% – 2% on stamp duty. This is done to give a boost in increase of the property ownership by women. So, on a property worth Rs 70 lakh, a woman borrower can save around Rs 70,000-1,40,000.

Property comes with another cost – Stamp duty. And indeed a difference of a few percentage can make a huge difference in the home ownership cost. Home loan is financed at about 80%-90% of the property cost and sometimes even 100% depending from case to case. The percentage of stamp duty varies from one state to another. Alike interest rate, women borrower here also gets a concession of 1% – 2% on stamp duty. This is done to give a boost in increase of the property ownership by women. So, on a property worth Rs 70 lakh, a woman borrower can save around Rs 70,000-1,40,000.

Women borrowers stand eligible for a tax deduction on the home loan repayments, with maximum of Rs1.5 lakh and Rs2 lakh on the principal and interest repayments respectively only if she have separate income source. Eventually women can reduce their taxable income by a total of Rs 3.5 lakh through their home loan repayments. The ones applying for a home loan along with their husbands as a co-borrower can receive the tax deduction in an equal proportion.

Women borrowers stand eligible for a tax deduction on the home loan repayments, with maximum of Rs1.5 lakh and Rs2 lakh on the principal and interest repayments respectively only if she have separate income source. Eventually women can reduce their taxable income by a total of Rs 3.5 lakh through their home loan repayments. The ones applying for a home loan along with their husbands as a co-borrower can receive the tax deduction in an equal proportion.

Certain special schemes are run by the Banks/NBFC’s on home loans for women leading them towards financial independence. Being an active members of home buying decision Banks/ NBFC’s also prefer to lend to them. Being single or married does not become a hurdle in their buying process

Certain special schemes are run by the Banks/NBFC’s on home loans for women leading them towards financial independence. Being an active members of home buying decision Banks/ NBFC’s also prefer to lend to them. Being single or married does not become a hurdle in their buying process

These are some of the benefits that women borrowers enjoy in the case of a home loan. But choose a lender that can offer you a loan at a much lower interest rate than its competitors. Being a punctual payer and less defaulters’ banks give preference to female buyers. It’s a good idea to buy a home in wife’s name as a borrower or a co-borrower. If you can’t buy the property in your wife’s name, a joint ownership can prove to be beneficial for both of you. Every individual have their own financial health and obligations, so it’s important to discuss the advantages and disadvantages with your advisor. If you find it difficult to take decision specifically for your needs and situation then take a call from the experienced team of Mudra Homes and get yourself a fair deal as per your requirement.