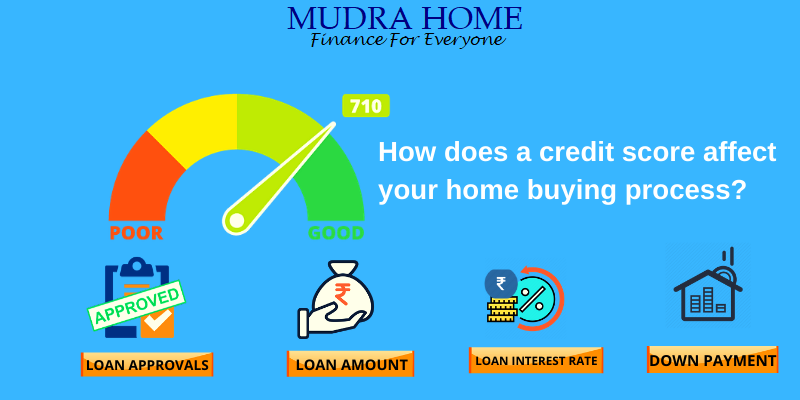

Buying a home is a long-awaited part of everyone’s life. As you prepare to buy a home, there are a few factors to understand, and your creditworthiness is one of them. Credit scores evaluate a person’s ability to repay the loan amount. This is a three-digit number calculated by credit bureaus across the country by collecting consumer data from clients and lenders. The calculation is based on factors such as the loan repayment history, the duration of existing loans, etc. The value of the credit score varies between 300 and 900.

When applying for a home loan, banks will assess your creditworthiness to determine if you are a responsible borrower. A higher credit score between 750 and 900 is considered a good value and can bring you several benefits, such as Quick loan approvals, lower interest rates, etc. Paying your credit card bills and instant messages on time can improve your credit score.

Loan approvals:

Approval of a loan can also depend on your credit rating. Generally, a minimum loan value between 620 and 650 is required to obtain a home loan. If your score is not satisfactory, the best thing to do is contact your bank to see how you can improve the number.

Loan amount:

If your credit score is low, the amount of credit you are given is likely to be less than the amount you applied for. For example, if you need a home loan for Rs. 30 lakhs with a lower credit rating, the bank may not approve as much. To get the privilege of obtaining a higher sanctioned loan amount, you should try to achieve a higher credit score.

Loan interest rate:

The interest rate on the loan is another criterion that is affected by your creditworthiness. So, if you have a higher credit rating, lenders will consider offering lower loan interest rates. Although the rate difference will be small, the monthly EMI will decrease significantly.

Down Payment:

A lower credit score can lead to an increase in the amount of the down payment when buying a home. This is to ensure that the buyer is serious about repaying the loan. For example, if the usual deposit limit is 10% of the total, the lender may ask you to pay 20%.

We hope that you now have a clear idea of your credit rating and the implications for buying a home. As mentioned above, higher creditworthiness gives you attractive loan offers, low-interest rates, longer payment terms, higher loan amounts, etc. If your creditworthiness is low, try to make all payments on time for the next several months and you can get a higher score. Also, it is important to keep track of your score to see if it is improving or not.

So if you can’t wait to buy a home, keep a good payment history. You can verify your creditworthiness through online portals or contact a financial expert.