Reviewing your mortgage eligibility criteria is a critical step in the entire home loan process. Banks and real estate finance firms approve mortgage applications from borrowers who meet their eligibility criteria, while those who do not meet the lender’s requirements may be rejected. However, the good news is that it can improve your credit score. As a borrower, you can monitor and even improve your eligibility so that your mortgage is approved on the first try. This can be done with the help of some simple and logical tips and tricks.

1. Pay off your existing loans:

Paying off existing loans can help improve your chances of getting the loan approved. Make sure you have no loans or debt when you apply for the loan. Pay off your personal or vehicle loan, as well as your credit card debt, before you begin the loan application process. If you tend to use your credit card regularly, make a habit of paying all your credit card debt on time so you don’t have to pay interest on your credit card expenses. Borrowers who are out of debt when applying for a home loan are more likely to get the loan.

2. Make a note of your variable compensation:

Another way to increase your eligibility for a home loan is to provide evidence of your variable payment with your income records. Many companies offer their employees monthly bonuses and year-end bonuses that can significantly increase their annual income. This is known as variable compensation. Lenders take your variable compensation into account when calculating your credit eligibility, so be sure to keep track of this.

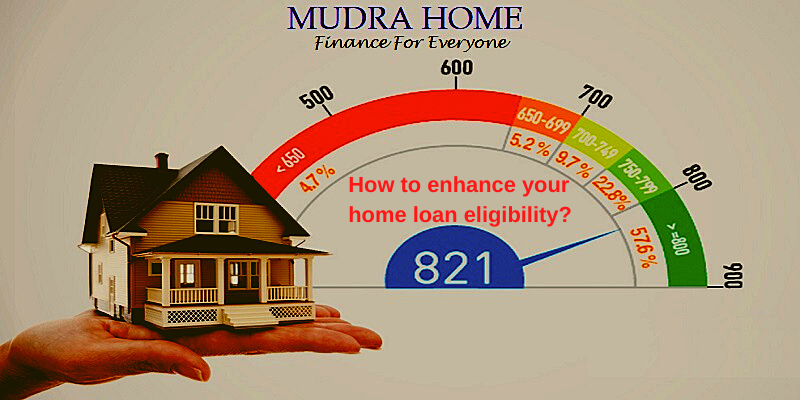

3. Work to improve your credit scores:

All lenders take your credit scores into account when evaluating your mortgage eligibility criteria and ask you to provide your credit scores. Generally, you need a credit score of 750 to be eligible for the loan. If your credit score is less than 750, your loan may be rejected. You can improve your credit score by paying off any existing loan while maintaining a credit utilization of just 30% of your credit card spending limit. Also, pay off all credit and EMI debts on time. A good loan repayment history can increase your credit score dramatically.

4. View additional sources of income:

If you have additional sources of income, you can view them, as they can also improve your eligibility for a home loan. You can earn income from sources such as time deposits, mutual fund dividends, business income, or even rental income from other real estates. Additional sources of income are essentially those outsides of your monthly net (disposable) income that you can demonstrate to increase your eligibility.

5. Opt for a joint loan:

One of the best ways to improve your mortgage eligibility is to apply for a joint home loan. Applying for a loan from another applicant who is employed and has monthly income can increase your chances of obtaining the loan on a larger scale. When choosing a joint loan, the lender takes into account the income of both applicants. You also get a larger loan amount.

6. Opt for long-term loans:

A home loan is available for a term of up to 25 years. By working long term, you are essentially showing the lender that you have plenty of time to pay off the loan. Longer terms also result in lower monthly EMIs, and the lender is confident that you can repay the loan in a timely manner, reducing risk to lenders. Before applying for a home loan, you should check the eligibility criteria for a home loan. The tips above can help you improve your credit score. Therefore, you should consider them before starting the loan application process.