One of the main reasons some people prefer to stay away from stocks and invest in other assets like government bonds and time deposit accounts is that the stock market is far from stable. The investment can almost be explained as a roller coaster. Formally, a market correction is described as a decrease of at …

What was the first thing you thought about when you asked for a loan from a bank? Most people react to the interest rate! They assume that the bank with the lowest interest rate is your best option. But we are not telling you the whole truth in this communication. There are also other fees …

When you get a loan, you must repay it to the lender within a certain period of time. The repayment includes both principal and interest from a predefined number of monthly payments. Simply put, repaying the loan through a series of scheduled payments, commonly known as EMI, that includes both the principal amount outstanding and …

Every year a good financial plan starts with a solid budget. Whether you’re looking to pay your bills or save for a dream vacation, budgeting is your first step in reaching your financial goals. Follow these steps to establish a realistic budget. DETERMINE YOUR INCOME Start with the amount of money you make after taxes …

There may be a time in your life when you took a break between jobs, wanted to start over, or were hoping to start your own business. During these stages, people control their spending. However, there are times when you may need cash right away. You can always apply for a personal loan for such …

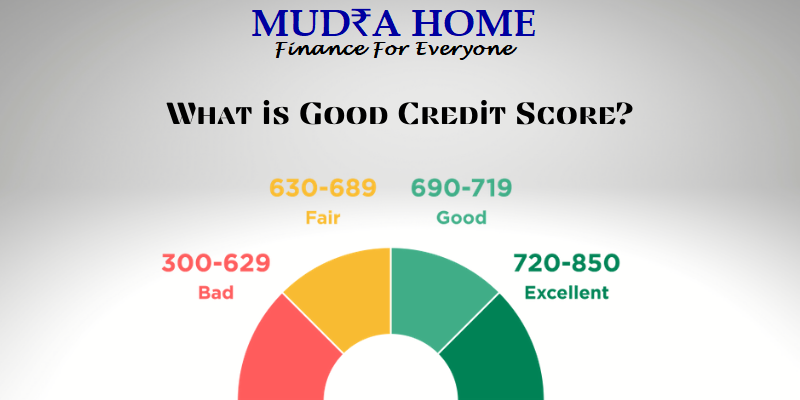

What exactly is a credit score? If you’ve ever tried to buy an expensive item, like a house or car, the finance company has likely informed you of your creditworthiness. This is one of the most important factors that lenders consider when deciding whether to grant you a loan or not. Credit card companies, insurance …

India’s fintech sector may be young, but it is growing rapidly, driven by a large market base, an innovation-driven startup landscape, and support for government policies and regulations. Several new companies populate this emerging and dynamic sector as traditional banking institutions and non-bank financial companies (NBFCs) are catching up. NASSCOM predicts that the Indian fintech …

AI as a blockchain is a revolution in technology. It makes the work of different industries easier and more efficient. The evolution of AI is leading to great revolutions in all industries, but the most useful thing about AI is loan and credit management. Automated systems cost banks 50-90% less than the labor of hired …