Total public debt, measured as debt to government gross domestic product (GDP), is expected to remain high at 30-31% in the current fiscal year 2022-23, about the same as the previous fiscal year at around 31, 5 %. said the largest national rating agency CRISIL in its report published on November 10. Additionally, the report …

Many people have this habit of keeping track of their expenses. While not an uncommon habit, it has transformed avatars in recent years. People used to keep track of their spending on paper. But now there are hundreds of free apps that will do it automatically. Just search “Expense Tracker” in your phone’s app store …

The cost of education at foreign institutions, already much higher than its Indian counterparts, has risen sharply in recent decades. While most major banks and some non-bank financial firms offer study abroad loans, large loan amounts and tighter work visa restrictions increase the risk of remaining in debt. This makes it even more important to …

What was the first thing you thought about when you asked for a loan from a bank? Most people react to the interest rate! They assume that the bank with the lowest interest rate is your best option. But we are not telling you the whole truth in this communication. There are also other fees …

In order to obtain a mortgage loan, the applicant must present a series of documents related to his KYC, history of the property he wishes to buy, income, etc., depending on the category of the client (employee / self-employed / merchant / NRI). The required documents vary from bank to bank. Below are some lists …

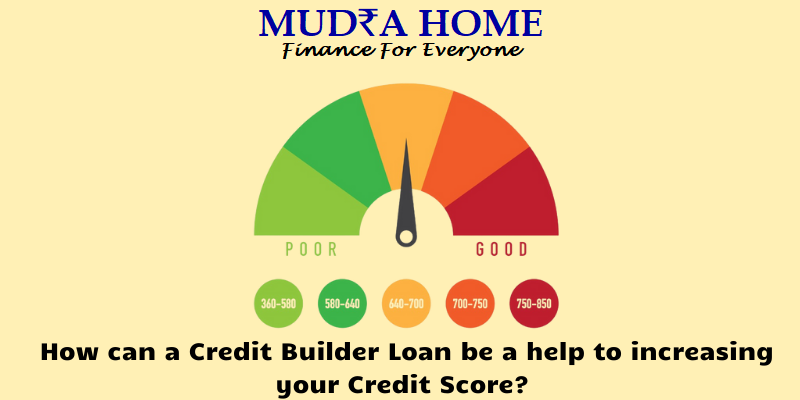

Trying to get credit can be challenging. This is especially true if you have no credit or bad credit and cannot get credit. Your previous payments history is one of the most important parts of your credit history. Failure to obtain permission to borrow will not allow you to improve your score and show that …

When should you apply for a personal loan? Sometimes you may have extraordinary or unforeseen expenses that you can finance from your income, such as B. a children’s wedding, a home improvement, or even a vacation. During these times, it is advisable to apply for a personal loan to deal with this temporary lack of …

Debt management refers to an informal agreement with unsecured creditors to pay off a debt over a period of time, usually by extending the time it takes to pay off the debt. As part of debt management, and SOA is offered to creditors. In this way, your disposable income, evaluated by the debt management company, …