One of the main reasons some people prefer to stay away from stocks and invest in other assets like government bonds and time deposit accounts is that the stock market is far from stable. The investment can almost be explained as a roller coaster. Formally, a market correction is described as a decrease of at …

Your credit history tells you about your credit history. It is a mirror of his responsibility for his debts. Your credit history contains the history of your credit, credit cards, and credit accounts. When you opened it, how much money did you take and return on time? Your credit history is a consolidated record of …

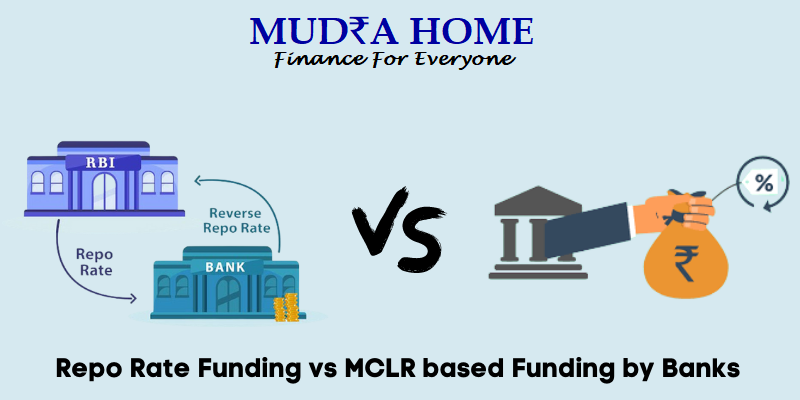

The Reserve Bank of India (RBI) introduced the Marginal Borrowing Rate (MCLR) on April 1, 2016, to offset the base rate, which was the benchmark rate for everyone at the time. of commercial banks. However, the banks’ delay in passing on the benefits of low repurchase rates to clients under the MCLR program prompted the …

In order to obtain a mortgage loan, the applicant must present a series of documents related to his KYC, history of the property he wishes to buy, income, etc., depending on the category of the client (employee / self-employed / merchant / NRI). The required documents vary from bank to bank. Below are some lists …

When you get a loan, you must repay it to the lender within a certain period of time. The repayment includes both principal and interest from a predefined number of monthly payments. Simply put, repaying the loan through a series of scheduled payments, commonly known as EMI, that includes both the principal amount outstanding and …

When should you apply for a personal loan? Sometimes you may have extraordinary or unforeseen expenses that you can finance from your income, such as B. a children’s wedding, a home improvement, or even a vacation. During these times, it is advisable to apply for a personal loan to deal with this temporary lack of …

Debt management refers to an informal agreement with unsecured creditors to pay off a debt over a period of time, usually by extending the time it takes to pay off the debt. As part of debt management, and SOA is offered to creditors. In this way, your disposable income, evaluated by the debt management company, …

If you haven’t already, it probably won’t be long before you run into a situation in life where someone asks you to check your balance. From buying a new cell phone to obtaining a mortgage, businesses use credit reports and ratings to assess your creditworthiness and establish your credit terms. Credit scores are based on …