What exactly is a credit score? If you’ve ever tried to buy an expensive item, like a house or car, the finance company has likely informed you of your creditworthiness. This is one of the most important factors that lenders consider when deciding whether to grant you a loan or not.

Credit card companies, insurance companies, and even lenders use credit scores to determine loan amounts and interest rates. Your credit score is based on your credit score and can have a big impact on how much you end up paying.

A credit score is a numerical representation of your risk as a borrower based on the information in your credit reports. In other words, it tells lenders how likely you are to repay the amount you incurred as debt.

Credit scores are one piece of the puzzle that lenders use to determine whether or not they will grant you credit. A good credit score can help you access a wider range of loan offers. And if a lender approves your loan application, good or excellent credit can help you get lower interest rates and better terms.

In general, the higher your score, the better your chances of being eligible for better credit, including lower interest rates and fees. This means significant savings over the life of the loan.

A good score does not necessarily mean that your credit will be approved or that you will get the lowest interest rates since lenders also take into account other factors. However, understanding your credit scores can help you decide what offers to apply for, or how to work on your credit before applying.

There are many different credit scoring models, each using a unique formula to calculate credit scores based on information on your credit reports. Even the most popular credit rating companies, FICO and VantageScore, have several credit scoring models that provide different scores.

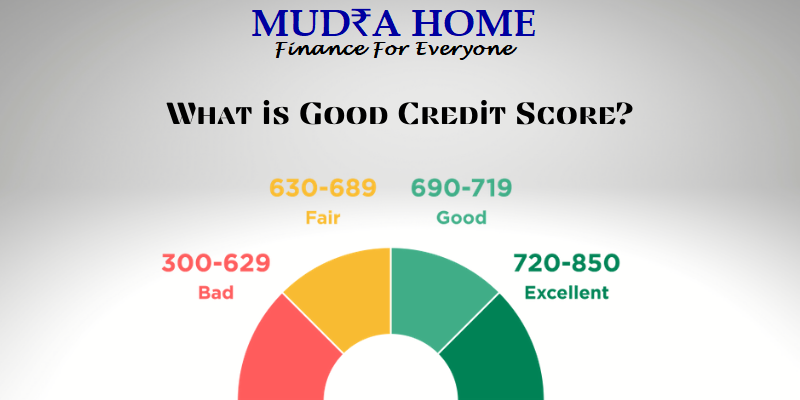

While there are many different credit scores, the most popular models use a scale of 300 to 850. Within that scale, there are general credit score ranges that can help you interpret the importance of your chances of winning.

Bad credit can make it difficult to approve an unsecured loan or credit card. But a bad credit rating is not a financial dead end. Certain financial products, such as secured credit cards, can help working people increase their credit. These products can be useful stepping stones to better access to credit if you use them carefully.

Be aware of potential fees and higher interest rates on loan products. Also, make sure the issuer or lender reports to the three major consumer credit bureaus: Equifax, Experian, and TransUnion, so that important actions such as B. Making payments on time can contribute to your bottom line.

When comparing your options, keep in mind that applying for a new loan or credit card can lead to difficult research that can negatively affect your score. Loans with pre-approval or pre-qualification options can give you an initial idea of the terms and conditions you may qualify for.

Those with the best credit scores are more likely to be eligible for loans and credit cards with low-interest rates and good repayment terms. But having a good or good credit score doesn’t mean you should be ashamed of all the loans or credit cards out there. A lender may reject an application for any other reason, such as a high debt-to-income ratio.

Regardless of your scores, it’s a good idea to keep an eye on your credit reports to see what lenders will see after you apply.

There are many different credit scores with different ranges. For major consumer loans, the highest loan value you can get is typically 850.

Remember, perfect credit scores may not be required to qualify for high loan and mortgage interest rates. Once you’re in the very good to excellent range, you probably won’t see a big difference in the rate bids say from 790 to 840. A move from 650 to 700 will likely have a bigger impact.