Life is long journey and there can be a need of funds at any point of time. Funds can be generated through various ways. Borrowing a loan from a Bank/ NBFC is safest among all. Buying a house or mortgaging an asset for the arrangement of funds for any reason. To spend for the fulfilment …

It is always better to be prepared and do homework before entering a financial transaction or making a strong move towards a purchase. Before borrowing it is always advantageous to know more about the cost of borrowing. The concept of loan is very much straight forward. The borrowed amount has to be repaid within a …

In Financial Industry, a loan is about lending money from one entity to another entity. A loan is a debt provided by an organization or an individual at an interest rate. This is evidenced by agreed terms and conditions that specify the borrowed amount, interest rate and the repayment date. These days all the Banks/ …

Number of times when students want to pursue further studies in finance. But getting a degree in financing or accounting is always confusing for them. Though, both the fields provide challenging, successful and rewarding career opportunities and in near future the fields will show the faster than average career growth For many of us it …

In finance industry Amortization is referred in two ways. Both refers towards the regular payments for a period of time. In English, generally mortem means “to kill”. it wont be wrong if we say that amortization refers to killing off the loan. Amortization refers to the repayment of secured loans with a fixed repayment schedule …

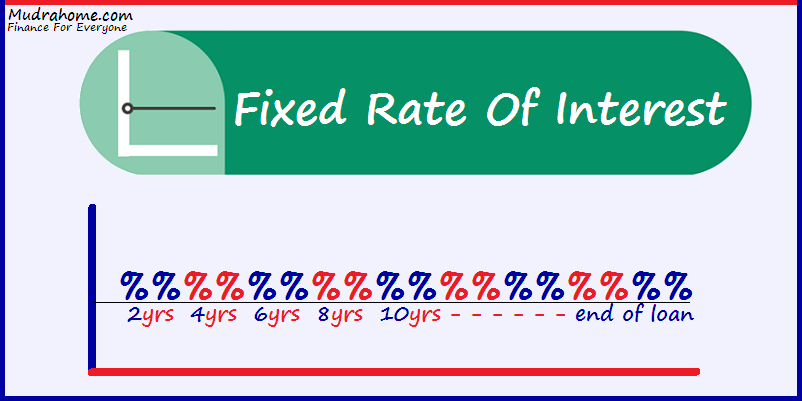

It is important to check while finalizing the Bank/NBFC who is giving an affordable interest rate as per the requirement of the borrower. One has to be cautious in not only understanding the EMI amount but also the mode of its calculation. EMI can be calculated by Fixed Rate Method, Floating Rate Method and Reducing …

It is important to remember that the interest rates do not change themselves. There are always certain situations like economic information on consumer spending or may be business inventories. There is no one person or organization that set the standards for thousands of nationalized and private banks. There is no one person to determine what …

An interest is the amount due over the period for the amount lent, borrowed or deposited. An interest amount depends on the principal amount, rate, compounding frequency and the time for which the amount is being lent, deposited or borrowed. An extra amount that a lender charges over the principal amount is normally expressed as …