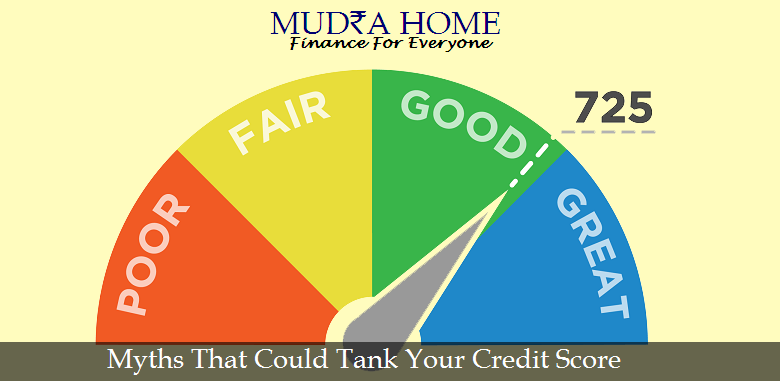

Let’s face it! A Credit score can be mystery as there is a lot of misinformation among us. Yes, it is important to maintain a good credit score but still you cannot believe in everything what you hear. A good intention but a wrong step can push your credit score in a wrong direction too. …

When we borrow a home loan, we don’t know about the future aspects coming in our way. With the fluctuation in economic market that influence the interest rates and the EMI’s we have to think about the necessary aspects so that these fluctuation doesn’t affect our present financial situations. These fluctuations show us a next …

In our life we borrow loans lot many times – smaller consumer loans, personal loans, car loan and a home loan. Yes, mostly we all borrow a home loan to fulfill the dream of owning a home for us, for our next generation. We want our family to safe and secure for their whole life …

Sometimes we find ourselves in some unenviable financial situations that require immediate funds, e.g. marriage. Personal loan is an easy option that can fulfill the need at that moment. Even if we already have previous debts we cannot step back from our responsibilities and commitments. We try lot many options to get the funds so …

Selfie…Selfie…Selfie…We all know about selfie and not only us but the new upcoming generation is also aware of the term. Although the widespread term is fairly new to is but the photos in selfie category is quite common since long Selfie A selfie is a self portrait picture clicked by a smart phone by holding …

Recently while flipping the pages of my newspaper I saw an article related to financial industry that deals with lending rates. That article was to lighten up our minds with the current changes going on. Many of us don’t know what a little increase in interest rates will bring an impact on our current home …

Life is uncertain and due to this uncertainty we can face any urgent need of funds. These funds can be needed for a short term and within a short time too. A medical emergency, fees for higher studies, a vacation or sudden expenses can arise at any point of time and this can lead us …

After completing the education, there are few things that every new comer in the industry wants to achieve. Finding stability in career and achieving your desires are on the top priorities of every young achiever. Their desires include applying for a credit card, buying new car, a new house, furnishing their parent place with all …