Borrowing a loan is little tricky for those with no financial knowledge. Those who go directly to the Bank/ NBFC to avail a loan face a number of challenges. These challenges can easily be solved by providing few details on the website of Mudra Homes . The borrower has to go through a various stages …

Dropline Overdraft Facilities can be termed as Smart Loan against properties which are generally offered from 1 Year to 15 years of tenure. The Dropline Overdraft facility benefits the borrower by reducing the original limit according the tenure sanctioned to the borrower. The overdraft facility can be used on monthly basis, quarterly basis, half-yearly or …

Buying a home is a life time decision and needs a strong financial commitment. When the borrower decides to buy the property and finalize the loan lender, the main problem they face is the loan amount. The loan amount given to the borrower is decided on pre decided terms and conditions. The documents, financials, income …

In India, owning a residential or a commercial property has its own advantage – a solid asset owner and an extra source of income by leasing the premises for rental income. Apart from monetary advantage of the property the owner is also benefited with the rent received from the premises. Many corporations and individuals earn …

Newspapers are flooded with news related to banking sector news… The financial market… Repo rates … Reverse repo rates… RBI decreased or increased its key interest rates and we all get confused how they are related to our financial system or our financial needs. How the loans we borrow are affected with these minute changes? …

It is difficult to understand the difference between RBI, the National Housing Banks and the Bank Ombudsman so easily. Let’s have a look to get a clear understanding about these topics and understand how they are helpful for us. National Housing Banks National housing bank is the financial institution established to operate as a primary …

The banking industry is highly competitive in terms of gaining more and more business. The market dynamics and the competition between the industry players have to follow the set rules and bring down the interest rates. It seems like a war between them where they want to attract more new customers with their attractive rates …

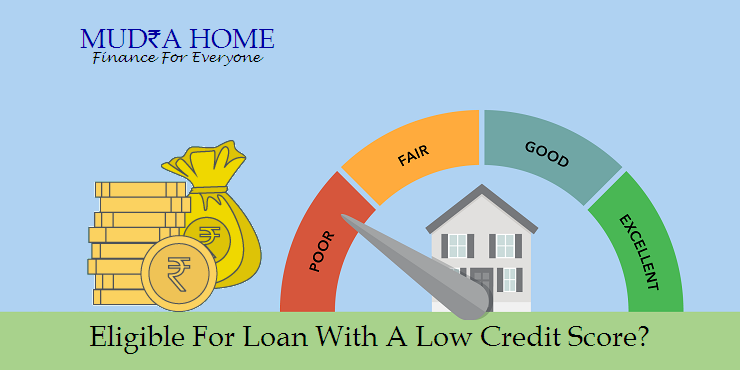

One can be in trouble in finding any kind of credit if the credit score is in bad shape, may be below 700 or 600. Your financial life is affected in many ways due to low credit score. Whenever you apply for any type of a loan your credit score influence the interest rates that …