Today, finding capital for the proper growth of the business is a biggest challenge. Banks/ NBFC’s and other financial institutions are coming up with advanced technology to meet the needs of acquiring funds for the business owners. The decision to borrow funds for your business and to choose the right lender is an important decision. …

What is a loan? In simple words, loan is an amount borrowed for a particular time and has to be paid back within a time frame along with surplus amount as an interest. This loan can be borrowed for our personal use, to buy a new property, for higher education of our kids or for …

India is a strong and a diversified country which is expanding its financial sector rapidly. The already existing financial organizations are trying to strengthen their base and services and new Banks/ NBFC’s are entering the banking sector to provide new financial products. Fund is the lifeline of any business. It can be for establishing a …

It seems to be quite exciting when the Bank/ NBFC say that you loan amount has been granted and especially for Business Loan. Business loan seems to be a great option to expand an office space, buying new machinery, recruit more people or manage day to day expenses. Whether you opt for a traditional bank …

It is always better to be prepared and do homework before entering a financial transaction or making a strong move towards a purchase. Before borrowing it is always advantageous to know more about the cost of borrowing. The concept of loan is very much straight forward. The borrowed amount has to be repaid within a …

In finance industry Amortization is referred in two ways. Both refers towards the regular payments for a period of time. In English, generally mortem means “to kill”. it wont be wrong if we say that amortization refers to killing off the loan. Amortization refers to the repayment of secured loans with a fixed repayment schedule …

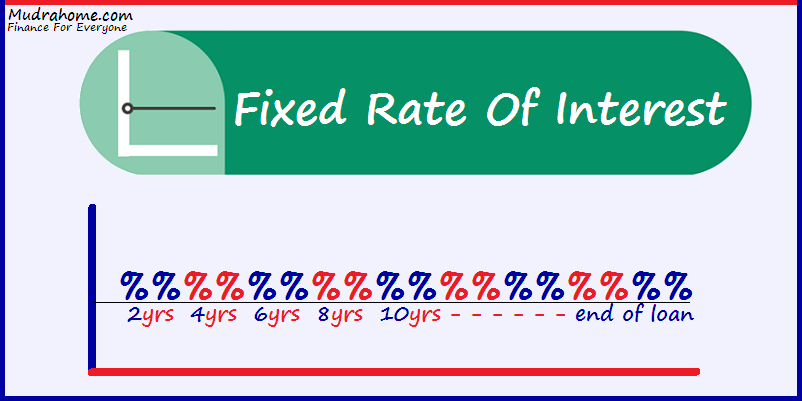

It is important to check while finalizing the Bank/NBFC who is giving an affordable interest rate as per the requirement of the borrower. One has to be cautious in not only understanding the EMI amount but also the mode of its calculation. EMI can be calculated by Fixed Rate Method, Floating Rate Method and Reducing …

It is important to remember that the interest rates do not change themselves. There are always certain situations like economic information on consumer spending or may be business inventories. There is no one person or organization that set the standards for thousands of nationalized and private banks. There is no one person to determine what …