The interest rates on fixed deposits have witnessed a significant increase in recent years due to reverse regime of interest rates and these interest rates are definitely expected to increase in near future. In present scenarios we all try to invest in some or the other way and if you are one of them who …

Mr. Shivhare bought a new residential property in 2003 and for the next 10 years he only focused to repay the loan. He had a single plan that helped him to successfully put his financial life in order. This was the biggest mistake that Mr. Shivhare did as he made a single investment in his …

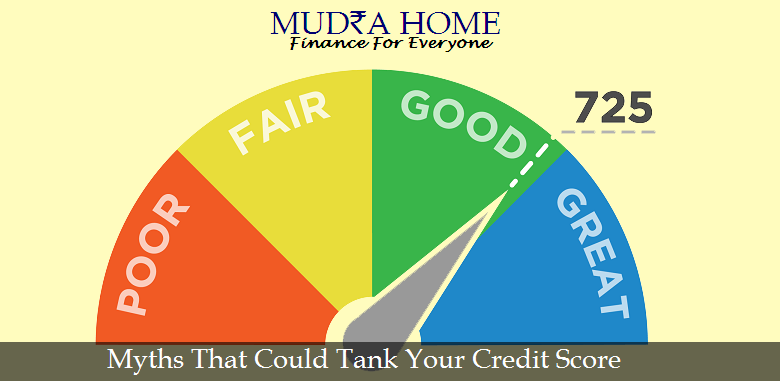

Let’s face it! A Credit score can be mystery as there is a lot of misinformation among us. Yes, it is important to maintain a good credit score but still you cannot believe in everything what you hear. A good intention but a wrong step can push your credit score in a wrong direction too. …

Selfie…Selfie…Selfie…We all know about selfie and not only us but the new upcoming generation is also aware of the term. Although the widespread term is fairly new to is but the photos in selfie category is quite common since long Selfie A selfie is a self portrait picture clicked by a smart phone by holding …

After completing the education, there are few things that every new comer in the industry wants to achieve. Finding stability in career and achieving your desires are on the top priorities of every young achiever. Their desires include applying for a credit card, buying new car, a new house, furnishing their parent place with all …

Due to the revolutionary ‘Goods & Services Tax’ or GST effective from July 1, 2017, most industries are waiting to see the positive or negative impact it brings. One such industry is the real estate industry which is not only growing but will also boom in near time. While GST along with RERA is expected …

We all know that buying a home is a life time commitment and especially if we thinking of taking a Home Loan to buy it. Whenever we go to any Bank/ NBFC and request for a home loan, financial institutions like Banks and Non-Banking Financial Companies (NBFCs) usually lend 80% of the property’s value as …

Investing for future is a difficult task. There is a lot of confusion with large number of emerging potential instruments and lots of options. For the people who are unaware and have never invested before in mutual funds, equity, etc. can discourage to invest due to many questions about the potential risk involved. But this …