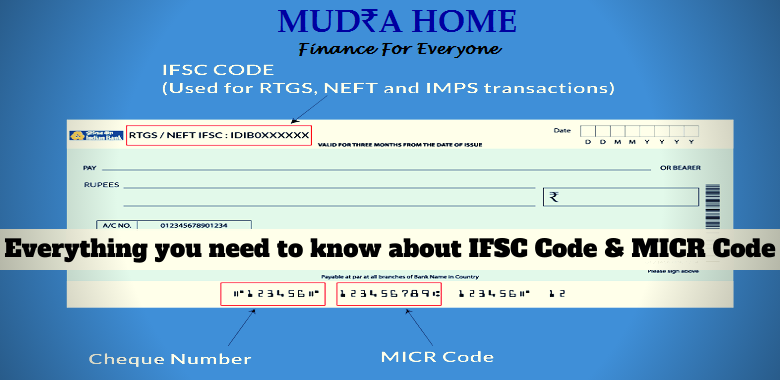

IFSC code is an eleven-digit alphanumerical number used for online fund transfer through Banks. Generally, the first four digits of the IFSC code are alphabetical representing the name of the Bank, the fifth digit is 0 and the last six digits represent the branch of the Bank identified with a number. The Reserve Bank of India assigns an eleven-digit code to each of the branches of all Banks. IFSC Code is assigned to each Branch of the Bank for the purpose of identification of the payer and payee bank branch. All internet banking transactions are only be facilitated through a valid Indian Financial System Code.

In order to determine the Bank name and branch with IFSC code, type search bank by IFSC code in google. Open the website bank IFSC code and type the IFSC code of the Bank. The Bank name and branch will be displayed.

MICR or Magnetic Inc Character Recognition Code is used for cheque transfer. The cheques deposited in the bank are scanned to authenticate the legality and credibility of the instrument. The Bank verifies the authenticity of the instrument and thus clear the instrument in a secure and fast manner. It is a 9-digit code of the branch. The MICR code is mentioned on the cheque leaf of the account holder. The first 3 digits of MICR code is numeric city code, the next 3 digits are bank code and the last 3 digits are branch code.

MICR code helps in faster processing of cheque and are used for processing of the cheques though electronic device (machine). MICR code is required for processing various financial transactions such as SIP or investment forms, fund transfer forms, etc.

How to find MICR Code

MICR number is written to the right side of the cheque no mentioned at the bottom of every cheque leaf.