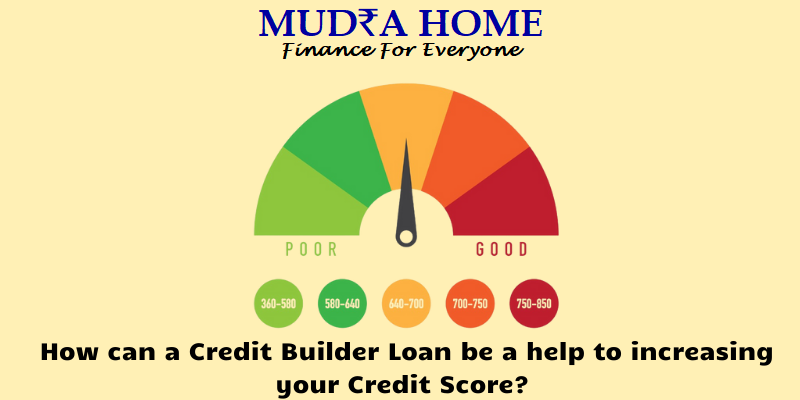

Trying to get credit can be challenging. This is especially true if you have no credit or bad credit and cannot get credit. Your previous payments history is one of the most important parts of your credit history. Failure to obtain permission to borrow will not allow you to improve your score and show that you are responsible for paying your debts.

There are several ways to access loans so you can see which lenders you can trust. However, one of the best options is a home loan. This is why.

Credit unions and some banks offer loans to lenders. They work differently than any other traditional personal loans.

With a traditional loan, you get your money upfront from a lender after you have been approved to borrow. Once you have the money, start paying your lender on a monthly basis. You pay the principal (the amount borrowed), as well as the interest plus interest on the loan. But if you don’t pay the full amount back, the lender will lose the money and have to try to collect it.

Lenders do not make traditional loans to people with little or no creditworthiness because they believe the risk of default is too high.

However, a credit-building loan involves a whole lot of different processes. You apply for the loan and, once approved, you start paying. However, you will not receive the borrowed money upfront. Instead, the lender deposits it into a bank account under their control.

Once you have paid the entire loan amount, you will have access to the funds that you have borrowed. In other words, you get approved for a loan first, but pay it off before earning the proceeds.

This type of loan doesn’t work well when you need to borrow money to finance a purchase that you can’t pay. But it’s great for building credit because it develops a positive payment history. Loans are easy to get as the lender assumes no risk, and save money in the process.

Home loans can be a great alternative to secured credit cards. They do not immobilize money indefinitely as you would if you were depositing money as collateral to guarantee a secure card. Once you have paid off the loan, you will receive the money you paid. You can use that money for whatever you want, even transfer it to an emergency fund or savings account for major purchases.

Credit loans are also reported to the credit bureaus and appear on your credit score as installment credit. Credit cards, on the other hand, are revolving debts. It’s good to have a mix of different types of loans on your credit report so that lenders can see that you are responsibly paying different types of debt.

When trying to get a loan, see if your local credit union or community bank offers a credit loan. If so, consider requesting it. It can help you get a credit score that can open all kinds of doors for you.