It is difficult to get a loan with a low credit score . Most banks look for a minimum score of 750 when deciding whether to approve of a loan application. Similarly, if you apply for a credit card with a 650 score, you have a much smaller chance of being approved. Even if you are approved with this score, you might be offered unattractive terms Rate of Interest in Loan.

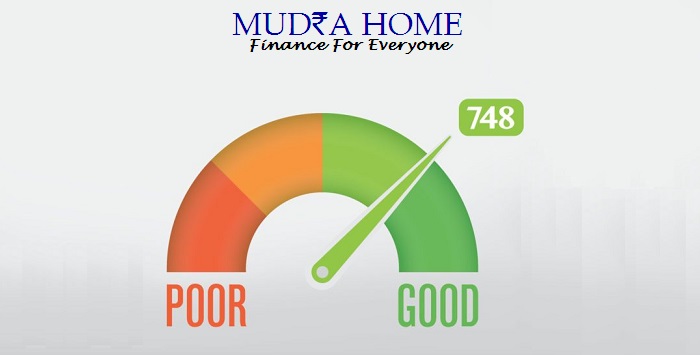

Your credit score is a three digit number between 300-900. It is ideal to have a score of 750 or above to qualify for loans. If your score is less than 750, it is advisable to increase your score before applying for a loan.

Taking a loan can be a complicated process for most people. The illustration below indicates what to expect at every step during the loan evaluation process. It helps understand how the credit decisioning works in banks and the steps they take before deciding to accept or reject a loan.

First- Applicants fill a loan application form.

Second- Hand it over the Bank.

Third- Bank check with CIBIL for Credit Score and Credit Report (Low Credit Score Leads to loan rejection)

Forth- High Credit Score leads to eligibility check basic documents.

Non Eligibility leads to rejection of loan application.

Eligibility will lead to loan approval.

700 is generally considered a good Credit Score

79% of the loans or credit card disbursed are to individuals with a Credit Score greater than 750.