An accident can happen at any time without warning and sometimes cause serious damage. Such an undesirable incident can have a significant impact on your finances. Not only can treatment be expensive, but it can also affect your earning potential if you are disabled. To protect yourself and your family from such a situation, it …

The word “bonus” sounds very positive. However, it is questionable whether these three words – no, right, and bonus – together have a similar impact. The skepticism could be due to the presence of “no” and “complaints”. But there is nothing to worry about. No Claim Bonus (NCB) on health insurance simply means a bonus …

Coronavirus cases are on the rise with no relief in sight, as India is expected to have the highest number of cases in the world. With a vaccine still in development, people are considering health insurance plans to meet their immediate financial needs if they test positive for the coronavirus and require hospitalization. Therefore, health …

The insured declared value (IDV) is the maximum insured sum determined by the insurer that is provided in the event of theft or total loss of the vehicle. Basically, IDV is the current market value of the vehicle. If the vehicle is totaled, IDV is the compensation that the insurer pays to the insured. The …

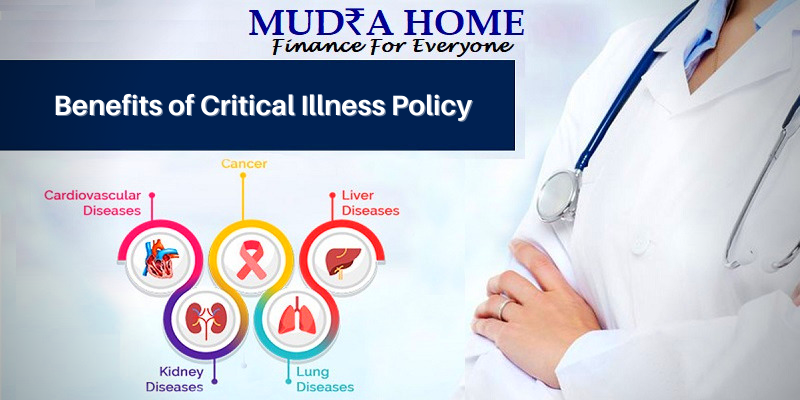

Traditional critical medical insurance or the dreaded medical insurance is an insurance product in which the insurance company pays the insured a lump sum in cash if they are diagnosed with a critical illness or undergo one of the surgeries covered by the medical insurance. Politics. Typical critical illness insurance can include cancer, organ transplants, …

Since the coronavirus changed its status from epidemic to pandemic, the 21st century has been divided into three timelines: the years before COVID, COVID, and after COVID. Right now you are on the COVID timeline where cases are increasing day by day. Although the initial lockdown slowed the spread of the virus, the numbers have …

One of the few reasons that employees don’t buy individual health insurance is to have their employer’s health insurance plan. While such coverage is really helpful, you could suffer a brutal blow if, during a medical emergency, you discover that your employer’s health insurance is insufficient. It is important to understand the pros and cons …

What is single premium insurance? Before switching to single premium hazard insurance, it is important to know what hazard insurance is. Term insurance is one of the simplest types of insurance products. The insurance company guarantees that in the event of the death of the insured, a fixed amount will be paid to the nominee, …