Gone are the days when parents expected their children to become their old age stick and be a part of their lives in their old age. And also with changing goals and aspirations children also want to move out of their comfort zone to achieve big in their lives. But, to achieve this so-called “big” …

We all borrow money from our friends, family, relatives or we reach out to Banks/ NBFC’S for funds in the form of a loan. When we borrow from Bank/NBFC we are supposed to repay the debt as EMIs. These EMIs consist of the principal amount as well as the interest part. But what if you …

We all are very well aware of the fact that to borrow a loan from a Bank/ Nbfc or any other financial institution there are certain rules that has to be followed by everyone. Even the lenders have certain policies which they cannot abide, not even for a small amount. Checking a credit score is …

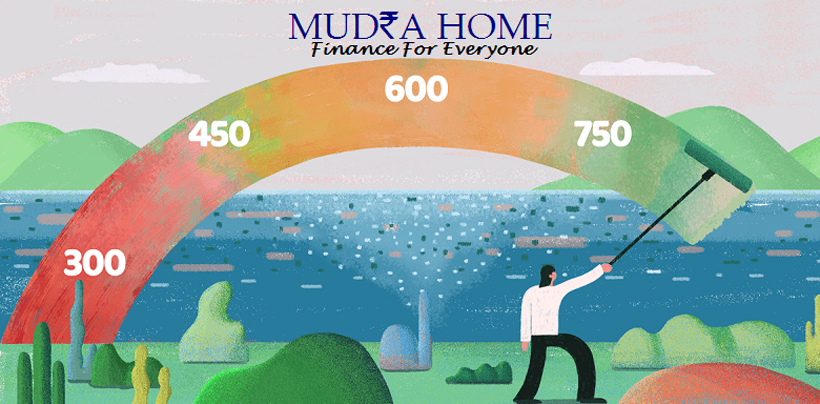

Credit score is a key feature that helps to decide the eligibility of loan amount and interest rates while borrowing for any kind of a loan. It is a misconception that credit score is only required for salaried professionals because of their limited income source. It is to note that credit score is equally important …

People borrow a loan for their requirements and sometimes even if they don’t require then also they borrow to save their own funds. Hence, the borrowing amount and the borrowers are not same. Every individual, every business is unique, so is every loan application and the requirements. There are many factors and variables that influence …

With the increasing accessibility to internet we all come to know about few terms related to financial industry, loans, agreement terms and conditions and many more. While applying for any loan or credit card the first thing is, do it yourself or the Bank/ NBFC will do for you, to check the credit score. What …

There are people who are unable to arrange the funds for their down payment and there are people who are blessed to pay for their homes in full in cash. Finding a right property that fits in our budget, further bank and its paperwork and EMI’s for the repayment of the loan seems to be …

Every one of us has a dream of owning a home to provide a sense of security to our family in the form of an asset as well as a memory to our next generation. With rising economy, the prices of properties are also growing. Due to these rising rates and decreasing lending rates, we …