In our life we borrow loans lot many times – smaller consumer loans, personal loans, car loan and a home loan. Yes, mostly we all borrow a home loan to fulfill the dream of owning a home for us, for our next generation. We want our family to safe and secure for their whole life …

A major number of home buyers opt to borrow a home loan to fulfill the dream for owning a house. However the question arises, when the buyer has enough funds to pay for the house in full? Does he still need a home loan? It is quite a topic of debate among property experts. When …

Buying a new home is one of the most momentous milestones of our life. Apart from serving as a security, a home is considered to be an invaluable asset in terms of overall value of the property. Therefore, buying a new home can be financially taxing and real estate prices rarely come down to fit …

Borrowing a loan is little tricky for those with no financial knowledge. Those who go directly to the Bank/ NBFC to avail a loan face a number of challenges. These challenges can easily be solved by providing few details on the website of Mudra Homes . The borrower has to go through a various stages …

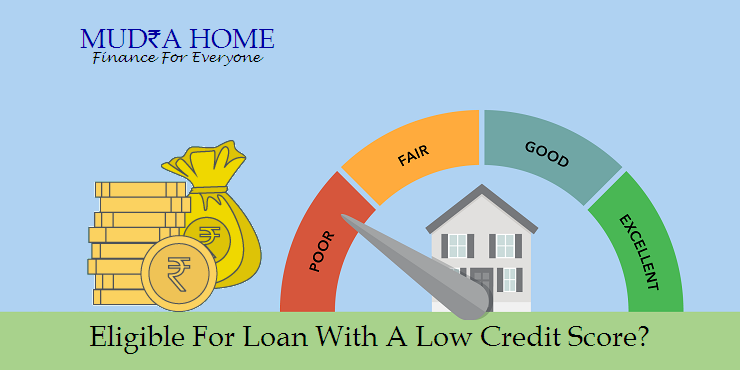

One can be in trouble in finding any kind of credit if the credit score is in bad shape, may be below 700 or 600. Your financial life is affected in many ways due to low credit score. Whenever you apply for any type of a loan your credit score influence the interest rates that …

Buying a home is a lifetime financial decision which demands a long term commitment. It is a longest debt and a biggest task in itself. Before borrowing a home loan the borrower has to make a detailed research about it. There are lots of questions that arise with a thought of borrowing a loan. Home …

Financial sector in India is a diversified sector which is growing day by day both in terms of new emerging entities and strong growth of existing financial servicing firms. The financial sector includes commercial banks, NBFC’s, insurance companies, co-operatives, pension funds and many other small financial companies. The financial sector in India mainly includes the …

It is important to remember that the interest rates do not change themselves. There are always certain situations like economic information on consumer spending or may be business inventories. There is no one person or organization that set the standards for thousands of nationalized and private banks. There is no one person to determine what …