Debt management refers to an informal agreement with unsecured creditors to pay off a debt over a period of time, usually by extending the time it takes to pay off the debt. As part of debt management, and SOA is offered to creditors. In this way, your disposable income, evaluated by the debt management company, …

Atal Pension Yojna was introduced by the Government of India in the budget year 2015-2016 for the purpose of pension or regular income after achieving the age of retirement. Under this scheme, the investor starts receiving a regular pension after attaining the age of 60. The scheme is administered and monitored by the Pension Fund …

Various payment and settlement systems in India have made it easier and faster to transfer money from one checking account to a different one. Account-holders do not need to wait days to receive money in their checking account. With the newest digital payment systems, money is often sent and received instantly anywhere, anytime. Many banks, …

Employee Provident Fund as the name suggests is an account under which a saving contribution is made for a salaried employee on a monthly basis. The said saving amount is deducted from the salary of the employee and is either a fixed amount of Rs. 1800% or 12% of the basic salary. Employee Provident Fund …

Axis Bank offers different savings accounts to meet everyone’s banking needs. With a range of accounts, from regular savings accounts to premium accounts, online savings accounts to offline accounts, the bank ensures that every type of client is covered. Axis Bank’s minimum balance requirements differ from one type of savings account to one type of …

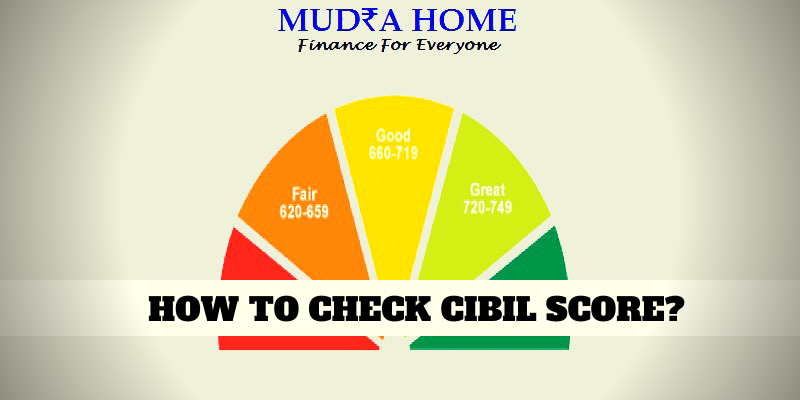

CIBIL score Is the most important factor when any individual or company applies for a loan with any Bank or Non-Banking Financial Institutions or Credit Agencies. The Banks or financial institutions thus offering loans analyze the credibility of the individual or company in terms of its capacity and the intention of paying back the availed …

The real estate sector remains one of the safest financial investment opportunities and a major asset. Faced with financial difficulties, solutions involving the pledging of existing assets as collateral are more advantageous than selling. With mortgages, you can get the most out of your inactive investments, including commercial and non-commercial real estate. Whether it’s to …