Credit card services are provided by banks to its customer so they can buy goods and services on credit. This service allows the customers to make lumpsum payment for their purchases on credit and in turn they may pay it back interest free before a particular date or decide to make periodic payments on some …

It is never a good idea to spend carelessly using your credit card as it is one of the easiest ways of landing in a debt trap. Getting out of this trap can be time-consuming and expensive. Says Gaurav Gaur, CEO and Founder, mudrahome.com Sometimes the interest rates can range between 36-48 percent on the …

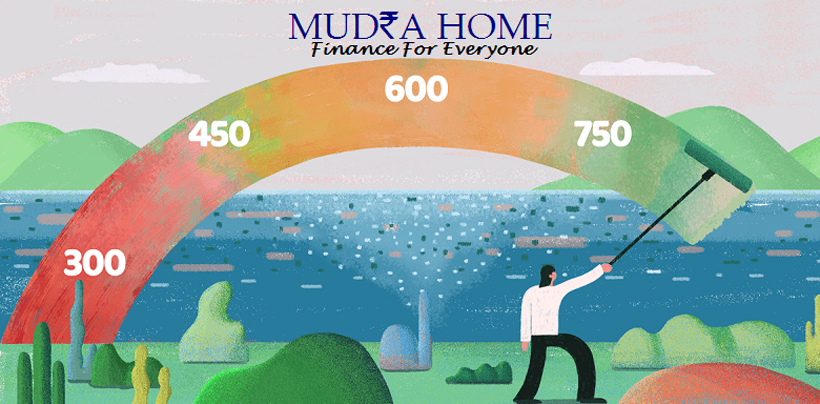

We all are very well aware of the fact that to borrow a loan from a Bank/ Nbfc or any other financial institution there are certain rules that has to be followed by everyone. Even the lenders have certain policies which they cannot abide, not even for a small amount. Checking a credit score is …

Life is a path full of ups and downs and anyone can across a situation where you are in an urgent need of money. What would be your first step? Anyone would look for an easiest way out, well it maybe a Payday loan or everyone’s all-time favorite friend, credit card. But it’s not wise …

Today, finding capital for the proper growth of the business is a biggest challenge. Banks/ NBFC’s and other financial institutions are coming up with advanced technology to meet the needs of acquiring funds for the business owners. The decision to borrow funds for your business and to choose the right lender is an important decision. …

With the increasing accessibility to internet we all come to know about few terms related to financial industry, loans, agreement terms and conditions and many more. While applying for any loan or credit card the first thing is, do it yourself or the Bank/ NBFC will do for you, to check the credit score. What …

We find a property to be our home with lots and lots of hope and then we further process for the home loan to give a shape to our dream. To the best of our knowledge, we collect and submit all the required documents and then wait for the positive response of the lender’s end. …

In real time situations we can come across the need of finance either for our kids for further studies or we have to arrange funds for the grand dream wedding of our daughter. The first question that comes in our mind is “from where to arrange for the money?” Though there are many options available …