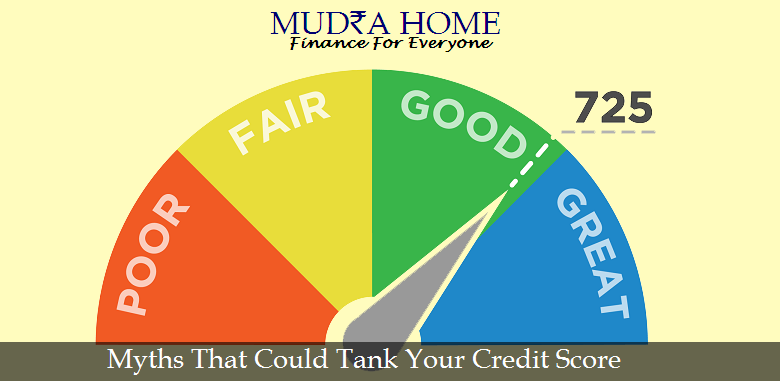

Let’s face it! A Credit score can be mystery as there is a lot of misinformation among us. Yes, it is important to maintain a good credit score but still you cannot believe in everything what you hear. A good intention but a wrong step can push your credit score in a wrong direction too. …

Life is uncertain and due to this uncertainty we can face any urgent need of funds. These funds can be needed for a short term and within a short time too. A medical emergency, fees for higher studies, a vacation or sudden expenses can arise at any point of time and this can lead us …

After completing the education, there are few things that every new comer in the industry wants to achieve. Finding stability in career and achieving your desires are on the top priorities of every young achiever. Their desires include applying for a credit card, buying new car, a new house, furnishing their parent place with all …

A major number of home buyers opt to borrow a home loan to fulfill the dream for owning a house. However the question arises, when the buyer has enough funds to pay for the house in full? Does he still need a home loan? It is quite a topic of debate among property experts. When …

Buying a new home is one of the most momentous milestones of our life. Apart from serving as a security, a home is considered to be an invaluable asset in terms of overall value of the property. Therefore, buying a new home can be financially taxing and real estate prices rarely come down to fit …

No financial institution is same, neither their working style nor their policies and so is their sanctioning criteria. Sanctioning criteria of a Banks/ NBFC varies from others but few key points are always considered while determining the sanction loan amount i.e. current income, credit score and your current liabilities. A credit score closer to 900 …

A loan means borrowing money to fulfill the dream or urgent requirements. In the process the borrower has to pay an interest along with the principal and the repayment is done over a number of years. Loan can be treated as a bridge between your requirement and your current inability to fulfill it on your …

What is a Debt? In simple word, the amount of money borrowed by one person from another is a debt. The most common form of debt is a loan that allows the borrower to borrow the money with certain terms and conditions and repay it on a later date along with some interest. Mortgages, auto …