If you are like me, in the last week you will have received at least 20-30 notifications to invest or buy gold through different methods. The festive season of Diwali and Dhanteras seems to be a gold-selling season. The fact is, whether it’s digital gold through UPI apps or gold coins, or even gold jewelry …

CIBIL score Is the most important factor when any individual or company applies for a loan with any Bank or Non-Banking Financial Institutions or Credit Agencies. The Banks or financial institutions thus offering loans analyze the credibility of the individual or company in terms of its capacity and the intention of paying back the availed …

We often come across terms as Credit Score, Credit Rating and Credit Report, but are they all the same or is there any difference? Let’s have a brief information about them. The Credit Score A credit score in layman terms is a statistical number that evaluates a consumer’s credit worthiness and is based on their …

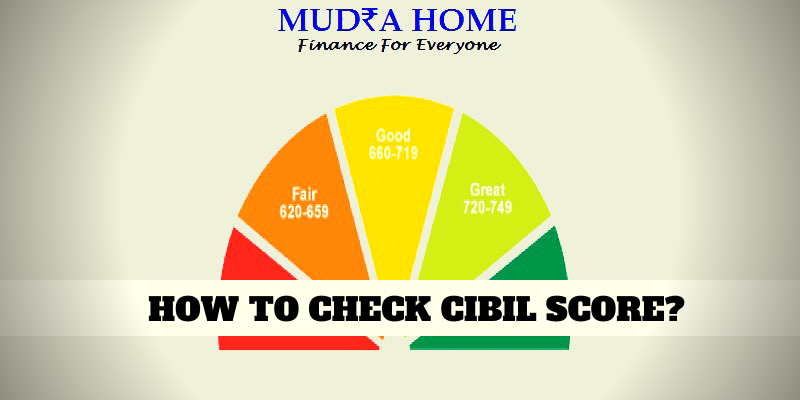

The Credit Information Bureau (India) Limited is India’s first Credit Information Company (CIC) was founded in August 2000. There has been a huge change in the way credit line is interpreted by both consumers and loan providers. What is CIBIL Score? CIBIL Score is a three numbered summary of your credit history. The score is …

We all borrow money from our friends, family, relatives or we reach out to Banks/ NBFC’S for funds in the form of a loan. When we borrow from Bank/NBFC we are supposed to repay the debt as EMIs. These EMIs consist of the principal amount as well as the interest part. But what if you …

A lifetime dream or an emergency can put any of us in a situation where you need to step in the premises of Bank or NBFC to arrange for the required financial aid. This financial aid will provide you with a financial plan for your business, security as a home or any other purpose. You …

A home is everyone’s dream and to own a home it takes years to plan and get into a position where you can think of borrowing money from Bank/NBFC or friends and relatives.When you think to borrow a loan from a financial institution, there are lot of factors that determine your eligibility for the amount …

We all are very well aware of the fact that to borrow a loan from a Bank/ Nbfc or any other financial institution there are certain rules that has to be followed by everyone. Even the lenders have certain policies which they cannot abide, not even for a small amount. Checking a credit score is …