Suhana, got her first campus placement in an International company with an excellent salary. Being from a middle class family, her dreams were big and she was highly motivated to achieve the best for herself. She wanted to give the best to her parents and her siblings too, who helped and motivated her in every …

Credit score is a key feature that helps to decide the eligibility of loan amount and interest rates while borrowing for any kind of a loan. It is a misconception that credit score is only required for salaried professionals because of their limited income source. It is to note that credit score is equally important …

Where ever you go or whatever you do,documents play an important role in your life. We now a days try to maintain all kind of documents related to banks, properties, schools, offices etc. Similarly, the documentation for the home loan procedure has always been a nightmare for many home loan applicants. The vast documentation is …

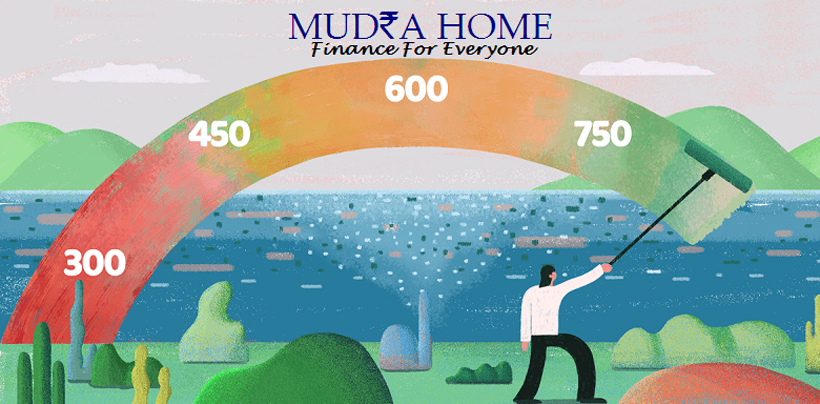

While borrowing any kind of a loan every lender verify few things about you and Credit score is rated as the highest among all. Credit score is a key parameter that enrage you to avail a loan on your terms and conditions, lower interest rates and many more benefits. A good credit score always help …

Life is a path full of ups and downs and anyone can across a situation where you are in an urgent need of money. What would be your first step? Anyone would look for an easiest way out, well it maybe a Payday loan or everyone’s all-time favorite friend, credit card. But it’s not wise …

With the increasing accessibility to internet we all come to know about few terms related to financial industry, loans, agreement terms and conditions and many more. While applying for any loan or credit card the first thing is, do it yourself or the Bank/ NBFC will do for you, to check the credit score. What …

With the current fluctuation and competitive market all the Banks/ NBFC’s try to acquire and retain new and existing customers with the best available market interest rates. After borrowing and successfully running a home loan for few years, we at times look for better alternatives to reduce the EMI or interest rates or other terms …

Every one of us has a dream of owning a home to provide a sense of security to our family in the form of an asset as well as a memory to our next generation. With rising economy, the prices of properties are also growing. Due to these rising rates and decreasing lending rates, we …