![HOW TO GET A PERSONAL LOAN WITH A LOW CIBIL SCORE HOW TO GET A PERSONAL LOAN WITH A LOW CIBIL SCORE - [A]](https://blog.mudrahome.com/wp-content/uploads/2020/06/HOW-TO-GET-A-PERSONAL-LOAN-WITH-A-LOW-CIBIL-SCORE-HOW-TO-GET-A-PERSONAL-LOAN-WITH-A-LOW-CIBIL-SCORE-A.png)

Have you ever applied for a loan? You should be aware that the bank analyzes and assesses your eligibility before offering a loan. This factor is not really based on an individual’s personality but is assessed by the bank, which focuses on the borrower’s finances and credit history. In India, the way bank24 and other …

CIBIL score is the credit score of a person or legal entity In India. It means the capability and creditworthiness of the individual or company based on their past track records. It is referred to by Banks and Financial Institutions to determine the risk involved in granting a loan or credit card to any individual …

CIBIL score Is the most important factor when any individual or company applies for a loan with any Bank or Non-Banking Financial Institutions or Credit Agencies. The Banks or financial institutions thus offering loans analyze the credibility of the individual or company in terms of its capacity and the intention of paying back the availed …

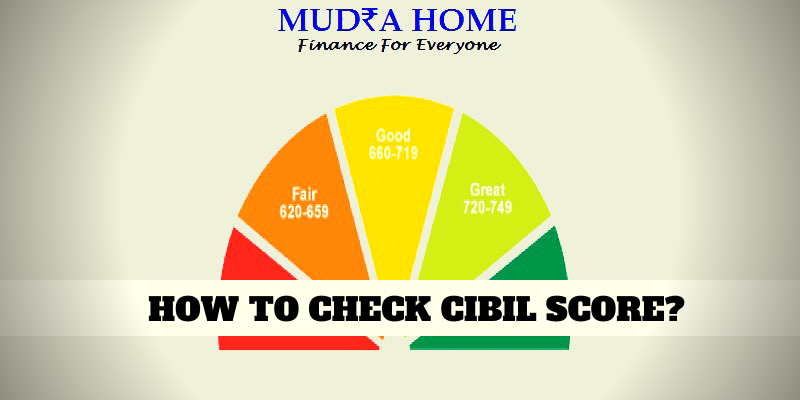

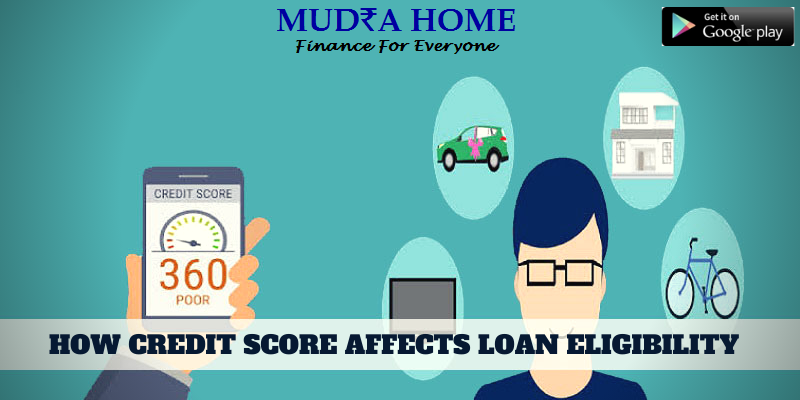

A good credit rating is a key to an easy and quick loan. The first thing a lender will consider is your credit score when applying for the loan. If you have a good credit score (a CIBIL Transunion score higher than 750 is considered good), your loan request will be processed. However, if your …

Whenever a personal loan is availed from a financial institution such as a bank or NBFC, your loan repayment track record is reported to the credit rating institutions. The credit score of any individual is an estimate of their repaying ability for the amount borrowed. A credit report will comprise complete details of your credit …

Funded Loan Facility Funded facilities are the loan where the bank or other financial institution allocates or issues capital in the form of loans, insurance, credit cards, or real cash (not a commitment) to their client. Bank overdraft, Overnight lending facility, Project Financing, Cash Finance, Running Finance, Financing against Defence saving certificates or other marketable …

Repaying your loan’s EMIs promptly reflects positively on your creditworthiness. You can talk with your bank or the financial institution, and schedule the EMI payment dates when you would be most comfortable and have sufficient funds in your account. Usually, the lenders fix the date closer to the date of receiving the salary. This helps …

A credit card is a very important financial instrument which has been a great boon in out lives today. Nevertheless, its of vital importance to know how to use it responsibly. The trick is to use it smartly so that you can maximize your savings and utilize a truckload of its benefits. However, ask yourself …