State Bank of India has been one of the leading providers of home loans in the country for decades. The bank is the largest public sector bank with the lowest mortgage rates in India. Like any other bank, SBI offers fixed and floating rates for home loans. And it currently offers home loans at a …

A home loan balance transfer is the means of transferring an existing home loan to another lender at a lower interest rate and other benefits. It is very similar to a new home loan. When a borrower makes a balance transfer, their entire outstanding balance is transferred to the new account, where the new lender …

When shopping online or over the phone, you are often asked for your credit card CVV number, sometimes called a card security code. CVV is short for Card Verification Value and is an important security feature. What is a CVV credit card? CVV is a three or four-digit code that is printed on your credit …

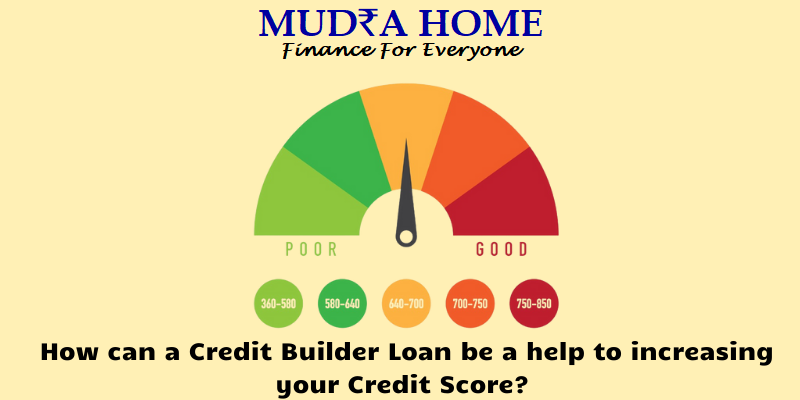

A credit score is a statistical number that evaluates the creditworthiness of an investor or consumer. It is based on the person’s credit history. Today, lenders focus on creditworthiness to measure the likelihood that a person will pay off his debts. A person’s credit score can range from 300 to 900, and the higher the …

Your credit history tells you about your credit history. It is a mirror of his responsibility for his debts. Your credit history contains the history of your credit, credit cards, and credit accounts. When you opened it, how much money did you take and return on time? Your credit history is a consolidated record of …

In order to obtain a mortgage loan, the applicant must present a series of documents related to his KYC, history of the property he wishes to buy, income, etc., depending on the category of the client (employee / self-employed / merchant / NRI). The required documents vary from bank to bank. Below are some lists …

Trying to get credit can be challenging. This is especially true if you have no credit or bad credit and cannot get credit. Your previous payments history is one of the most important parts of your credit history. Failure to obtain permission to borrow will not allow you to improve your score and show that …

Debt management refers to an informal agreement with unsecured creditors to pay off a debt over a period of time, usually by extending the time it takes to pay off the debt. As part of debt management, and SOA is offered to creditors. In this way, your disposable income, evaluated by the debt management company, …