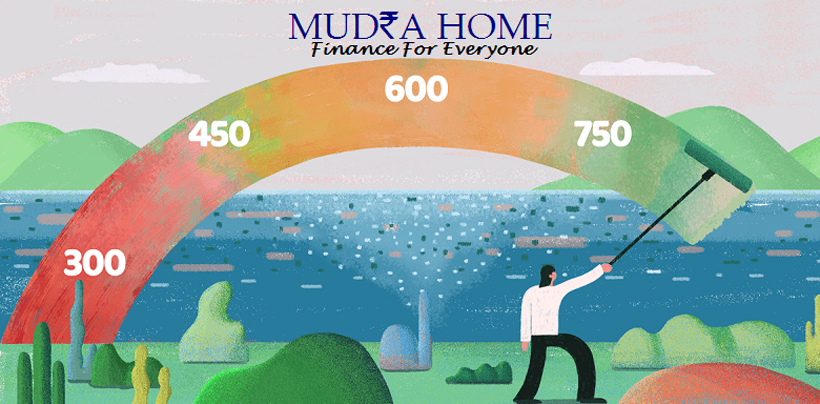

While borrowing any kind of a loan every lender verify few things about you and Credit score is rated as the highest among all. Credit score is a key parameter that enrage you to avail a loan on your terms and conditions, lower interest rates and many more benefits. A good credit score always help …

Life is a path full of ups and downs and anyone can across a situation where you are in an urgent need of money. What would be your first step? Anyone would look for an easiest way out, well it maybe a Payday loan or everyone’s all-time favorite friend, credit card. But it’s not wise …

Turnover means how much you earn throughout the year. These earnings are not calculated only on the basis of money but also on the other assets of the business. Other than the building, equipment and the fixtures installed in the premises there are certain other assets that a business owns and must be disposed or …

With so much of confusions about the ups and downs in the market interest rates, competitions, terms and conditions and too much of glossary of financial market. Every Bank/ NBFC and other financial institutions have some or the other way to acquire or retain the customers. Borrowing a loan is a hazardous task that comes …

Today, finding capital for the proper growth of the business is a biggest challenge. Banks/ NBFC’s and other financial institutions are coming up with advanced technology to meet the needs of acquiring funds for the business owners. The decision to borrow funds for your business and to choose the right lender is an important decision. …

With the increasing accessibility to internet we all come to know about few terms related to financial industry, loans, agreement terms and conditions and many more. While applying for any loan or credit card the first thing is, do it yourself or the Bank/ NBFC will do for you, to check the credit score. What …

With the current fluctuation and competitive market all the Banks/ NBFC’s try to acquire and retain new and existing customers with the best available market interest rates. After borrowing and successfully running a home loan for few years, we at times look for better alternatives to reduce the EMI or interest rates or other terms …

We find a property to be our home with lots and lots of hope and then we further process for the home loan to give a shape to our dream. To the best of our knowledge, we collect and submit all the required documents and then wait for the positive response of the lender’s end. …