In order to obtain a mortgage loan, the applicant must present a series of documents related to his KYC, history of the property he wishes to buy, income, etc., depending on the category of the client (employee / self-employed / merchant / NRI). The required documents vary from bank to bank. Below are some lists …

When you get a loan, you must repay it to the lender within a certain period of time. The repayment includes both principal and interest from a predefined number of monthly payments. Simply put, repaying the loan through a series of scheduled payments, commonly known as EMI, that includes both the principal amount outstanding and …

Every year a good financial plan starts with a solid budget. Whether you’re looking to pay your bills or save for a dream vacation, budgeting is your first step in reaching your financial goals. Follow these steps to establish a realistic budget. DETERMINE YOUR INCOME Start with the amount of money you make after taxes …

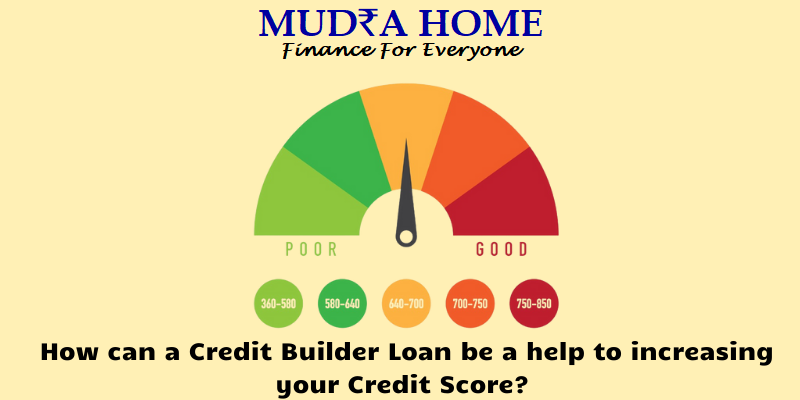

Trying to get credit can be challenging. This is especially true if you have no credit or bad credit and cannot get credit. Your previous payments history is one of the most important parts of your credit history. Failure to obtain permission to borrow will not allow you to improve your score and show that …

Personal loans are one of the most viable ways to meet your sudden financial needs. The amount guaranteed by this type of loan can be used for various purposes. This includes paying for tuition, wedding expenses, vacations, and even coverage for medical emergencies. Helps you make rush payments with ease. Personal loans also pay off …

While some people go for a cash-only lifestyle, most of us rely on credit to pay for the high cost of living over time. If you’re looking to buy an expensive item like a house or car, start or expand a business, remodel a kitchen, or pay for a college education, you can apply for …

When a financial emergency arises, a personal loan is the most popular option for obtaining money for many. With the increasing demand for this unsecured loan, it is not cheap, unlike other loans. The interest rate is usually higher and it takes a lot of work to get the best deal. Learning from the mistakes …

Whether your personal loan is unsecured or unsecured, it is a source of financing that can be used for virtually anything from debt consolidation to home renovation. For personal loans, the lender gives you a lump sum that you pay with interest in fixed installments, usually between 12 and 60 months. Refinancing credit card debt …