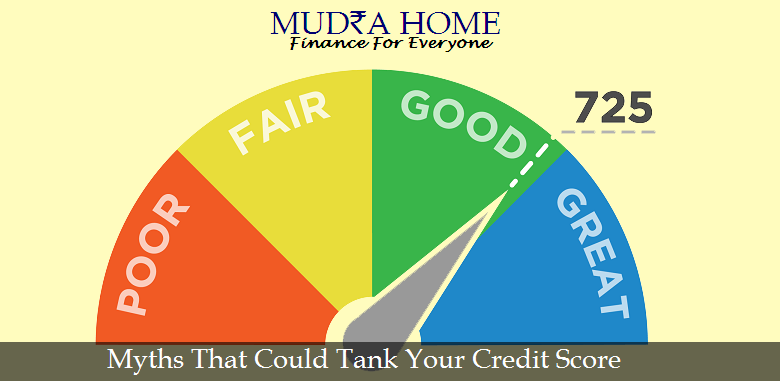

Let’s face it! A Credit score can be mystery as there is a lot of misinformation among us. Yes, it is important to maintain a good credit score but still you cannot believe in everything what you hear. A good intention but a wrong step can push your credit score in a wrong direction too. …

In our life we borrow loans lot many times – smaller consumer loans, personal loans, car loan and a home loan. Yes, mostly we all borrow a home loan to fulfill the dream of owning a home for us, for our next generation. We want our family to safe and secure for their whole life …

Sometimes we find ourselves in some unenviable financial situations that require immediate funds, e.g. marriage. Personal loan is an easy option that can fulfill the need at that moment. Even if we already have previous debts we cannot step back from our responsibilities and commitments. We try lot many options to get the funds so …

Recently while flipping the pages of my newspaper I saw an article related to financial industry that deals with lending rates. That article was to lighten up our minds with the current changes going on. Many of us don’t know what a little increase in interest rates will bring an impact on our current home …

There is a surety of availing lots of benefits due to cut down in interest rates of home loan as well as by the RBI. The lower interest rates of home loan benefits and encourages the customers of lower, middle and upper-middle segment to invest and buy a home. It is always better to pay EMIs and …

Home loan is a lifetime financial commitment for homebuyers and also at the same time it also involves huge risks for the Bank/ NBFC’s. This is the reason why Banks/ NBFC’s are very much concerned about extending home loan to people who are close to their retirement, regardless of their financial situation. People who are …

Loan is an easy way to borrow funds and repay later through monthly installments and is getting popular day by the day among consumers. Even after borrowing a loan, when we need more money we might find ourselves in a state of confusion, whether to borrow more or not. Whether to avail a top up …

In 2016, when our Honorable Prime Minister Mr. Narendra Modi changed the currencies and limit the deposit, retrieve and exchange of currency notes to know how much people have saved or they have collected as a black money in cash. The amount which was deposited in account was also estimated for every individual. The major …