Each time you take out a mortgage, the interest rate and the length of the loan are the main factors that determine the amount of the Assimilated Monthly Payment (EMI) to pay. Here are some ways a new or existing borrower can effectively reduce the EMI burden on their home loan. A. New Mortgage Borrowers …

Since diversification is the key to an investment portfolio that reduces risk, real estate will act as a safe haven to secure accumulated wealth in the current scenario. Today it is important for buyers to understand how to reduce the perception of risk when investing in real estate. Since diversification is key to reducing the …

Unsecured loans to continue your advance. Between the financials of 2015 and 2018, unsecured loans, including loans to individuals, small and medium-sized businesses (SMEs), and credit cards, experienced a compound annual growth rate (CAGR) of 27%, or almost four times the growth of bank loans of around 7%. This comes at a time when banks …

The spread of the Covid-19 pandemic has caused a gradual lockdown around the world. Many dimensions of our life are affected. On the positive side, we’ve experienced new joys, like B. Getting closer to our families, spending more time with them, learning new skills, and more. We have almost adapted to the changes that result …

If you’ve taken out a loan, the EMI monster will most likely suck up a significant chunk of your paycheck every month before you can slip it into your pocket. This not only means that you are spending less money, but it also means that you have little to no savings. It is a vicious …

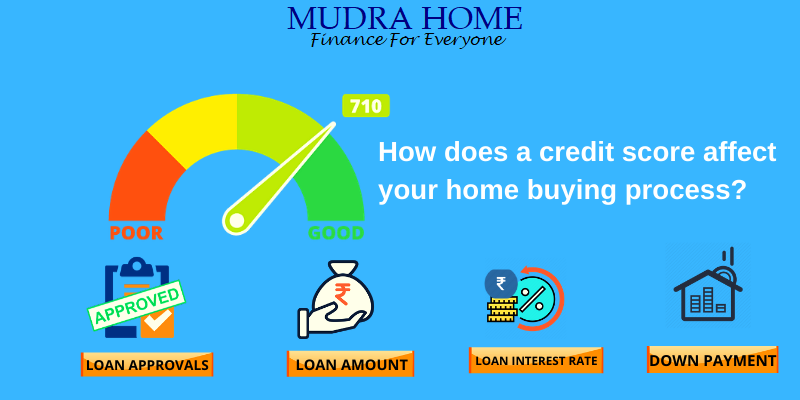

Buying a home is a long-awaited part of everyone’s life. As you prepare to buy a home, there are a few factors to understand, and your creditworthiness is one of them. Credit scores evaluate a person’s ability to repay the loan amount. This is a three-digit number calculated by credit bureaus across the country by …

For those looking to buy a property, these are the reasons why opting for a joint home loan would be a good idea. Common home loans often provide respite for many mortgage applicants, especially those struggling to get approved on their own. Although in most cases it is not mandatory to have a co-applicant when …

Loan against Property is an affordable financing solution to help organize finances for various expenses. Since the loan against the property is a secured loan, the interest rates and other fees are low compared to unsecured loans, such as personal loans. One of the most important considerations before applying for a home loan is the …