State Bank of India has been one of the leading providers of home loans in the country for decades. The bank is the largest public sector bank with the lowest mortgage rates in India. Like any other bank, SBI offers fixed and floating rates for home loans. And it currently offers home loans at a …

A home loan balance transfer is the means of transferring an existing home loan to another lender at a lower interest rate and other benefits. It is very similar to a new home loan. When a borrower makes a balance transfer, their entire outstanding balance is transferred to the new account, where the new lender …

When shopping online or over the phone, you are often asked for your credit card CVV number, sometimes called a card security code. CVV is short for Card Verification Value and is an important security feature. What is a CVV credit card? CVV is a three or four-digit code that is printed on your credit …

One of the main reasons some people prefer to stay away from stocks and invest in other assets like government bonds and time deposit accounts is that the stock market is far from stable. The investment can almost be explained as a roller coaster. Formally, a market correction is described as a decrease of at …

Your credit history tells you about your credit history. It is a mirror of his responsibility for his debts. Your credit history contains the history of your credit, credit cards, and credit accounts. When you opened it, how much money did you take and return on time? Your credit history is a consolidated record of …

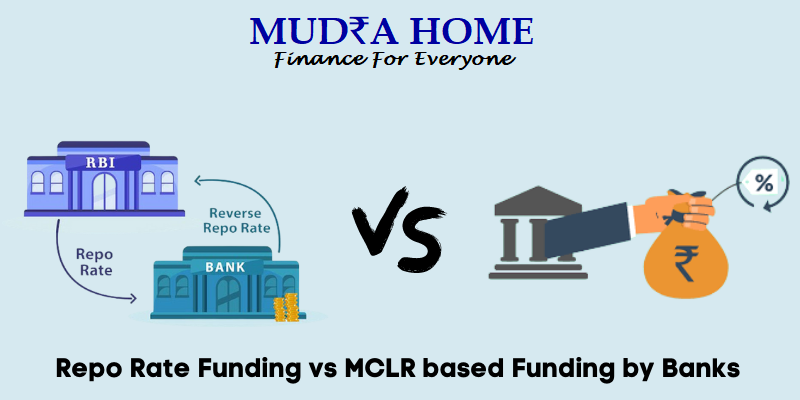

The Reserve Bank of India (RBI) introduced the Marginal Borrowing Rate (MCLR) on April 1, 2016, to offset the base rate, which was the benchmark rate for everyone at the time. of commercial banks. However, the banks’ delay in passing on the benefits of low repurchase rates to clients under the MCLR program prompted the …

There are several steps in planning for retirement, and the ultimate goal is to have enough money to stop working and do whatever you want. Our goal with this retirement planning guide is to help you achieve that goal. Step 1: Know when to start planning for retirement When should you start planning for retirement? …

In order to obtain a mortgage loan, the applicant must present a series of documents related to his KYC, history of the property he wishes to buy, income, etc., depending on the category of the client (employee / self-employed / merchant / NRI). The required documents vary from bank to bank. Below are some lists …