Home loans are a type of mortgage loan that allows individuals to purchase or refinance a home. They provide a convenient and affordable way to finance the cost of purchasing or upgrading a property. This type of loan is available from a variety of lenders, including banks, credit unions, and other financial institutions. Here are …

Choose a shorter repayment term. As mentioned earlier, a shorter loan term guarantees a faster full loan repayment; which leads to lower interest charges. You must understand that a higher interest payment does not necessarily mean a higher effective interest rate. What increases as the loan term increases is only the absolute interest payment, which …

State Bank of India has been one of the leading providers of home loans in the country for decades. The bank is the largest public sector bank with the lowest mortgage rates in India. Like any other bank, SBI offers fixed and floating rates for home loans. And it currently offers home loans at a …

Banks and real estate finance companies compete for home buyers with interest rates on home loans worth more than 14 billion rupees. With the State Bank of India, HDFC, and Kotak Mahindra Bank cutting mortgage rates to the lowest level in nearly 15 years, other lenders are preparing to join the race. Which banks recently …

If you are still waiting to buy a new home, now is a great time. Kotak Mahindra Bank and State Bank of India (SBI) cut mortgage rates effective March 1. The two banks cut interest rates by another 10 basis points (100 basis points = 1 percentage point). Kotak Mahindra Bank has cut mortgage rates …

Owning a home is a cherished dream that we all cherish. A home is a great investment that gives us a sense of financial security and a permanent roof over our heads. However, buying a home in today’s financial climate is not easy. Most people rely on home loans to make this dream come true. …

Each time you take out a mortgage, the interest rate and the length of the loan are the main factors that determine the amount of the Assimilated Monthly Payment (EMI) to pay. Here are some ways a new or existing borrower can effectively reduce the EMI burden on their home loan. A. New Mortgage Borrowers …

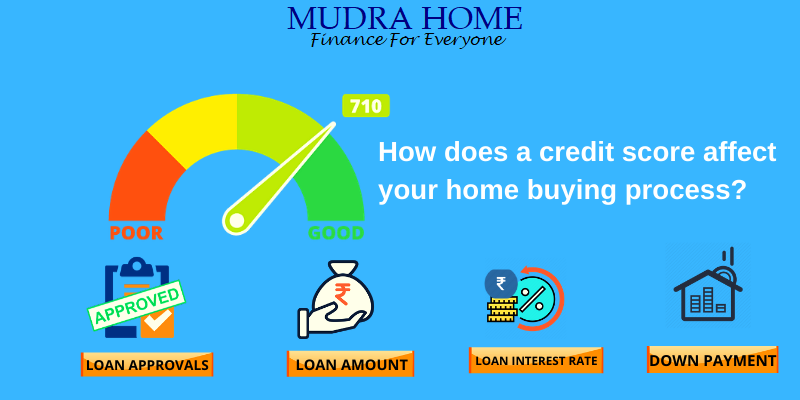

Buying a home is a long-awaited part of everyone’s life. As you prepare to buy a home, there are a few factors to understand, and your creditworthiness is one of them. Credit scores evaluate a person’s ability to repay the loan amount. This is a three-digit number calculated by credit bureaus across the country by …