For those looking to buy a property, these are the reasons why opting for a joint home loan would be a good idea. Common home loans often provide respite for many mortgage applicants, especially those struggling to get approved on their own. Although in most cases it is not mandatory to have a co-applicant when …

A mortgage is a long-term commitment, as it can take up to 30 years to pay back. This loan will help you to own a home with tax benefits; however, this also affects your current and future finances. Therefore, you should repay the loan as soon as possible by carefully managing related factors such as …

Getting a new business off the ground can be a daunting task, both financially and otherwise. In terms of mortgage eligibility, as a first-time entrepreneur, you can be barred from a number of loans. However, one source of financing you can count on is a real estate loan (LAP). For this secured business loan, you …

In the midst of the current crisis, everyone is looking for ways to save money. Did you know that you can do this with home loans? There are various tax deductions you may be entitled to, so you can claim up to Rs 7 lakh. Let’s take a look at some of the tax deductions …

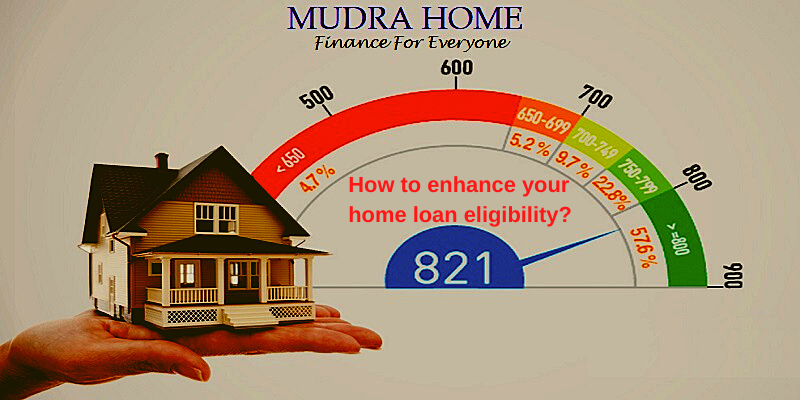

How can you improve your mortgage eligibility? Reviewing your mortgage eligibility criteria is a critical step in the entire home loan process. Banks and real estate finance firms approve mortgage applications from borrowers who meet their eligibility criteria, while those who do not meet the lender’s requirements may be rejected. However, the good news is …

![What is Home Loan Insurance and what are it's pros and cons_- [1]](https://blog.mudrahome.com/wp-content/uploads/2020/08/What-is-Home-Loan-Insurance-and-what-are-its-pros-and-cons_-1.png)

What is mortgage insurance? A home loan insurance plan is a plan in which the insurer pays the outstanding mortgage amount with the lender or the bank in the event of an unforeseen situation. Some of the comprehensive mortgage loan insurance policies cover the applicant, the home, and all of its contents. The premium paid …

Obviously, mortgage lenders have a long list of conditions that borrowers must meet to be eligible for a loan. Sometimes there are cases where an individual borrower, even if he meets the eligibility criteria for the home loan, may ask the guarantor to sign the loan document. For more information on these cases and the …

![Home loan_ fixed or floating interest rate_ which should be chosen_- [A]](https://blog.mudrahome.com/wp-content/uploads/2020/07/Home-loan_-fixed-or-floating-interest-rate_-which-should-be-chosen_-A-.png)

Getting a mortgage loan is very easy these days. However, choosing the best option is always a complex matter. You must do your homework well before jumping on something. When applying for a home loan, the first thing that bothers applicants is whether they opt for a fixed or variable rate. Let’s see which option …