In the past 18 months, the COVID-19 pandemic has ruined the finances of many. A difficult situation in which the relatives of deceased relatives found themselves was when they discovered mortgage loans that the deceased was paying. If a borrower dies without having fully paid the loan, the obligation falls on the co-borrower or legal …

Your credit history tells you about your credit history. It is a mirror of his responsibility for his debts. Your credit history contains the history of your credit, credit cards, and credit accounts. When you opened it, how much money did you take and return on time? Your credit history is a consolidated record of …

What was the first thing you thought about when you asked for a loan from a bank? Most people react to the interest rate! They assume that the bank with the lowest interest rate is your best option. But we are not telling you the whole truth in this communication. There are also other fees …

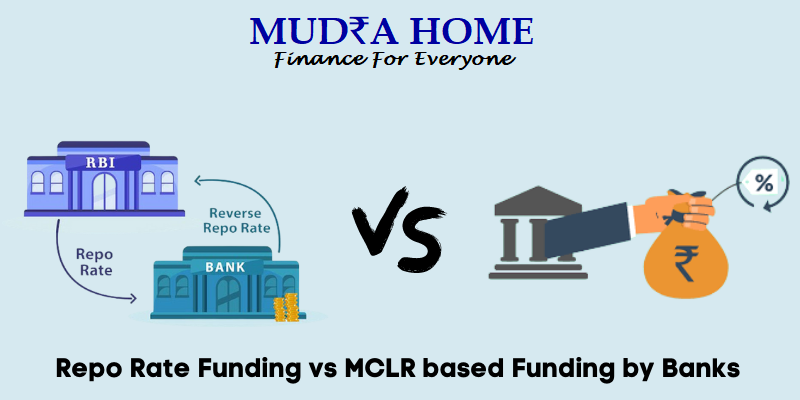

The Reserve Bank of India (RBI) introduced the Marginal Borrowing Rate (MCLR) on April 1, 2016, to offset the base rate, which was the benchmark rate for everyone at the time. of commercial banks. However, the banks’ delay in passing on the benefits of low repurchase rates to clients under the MCLR program prompted the …

In order to obtain a mortgage loan, the applicant must present a series of documents related to his KYC, history of the property he wishes to buy, income, etc., depending on the category of the client (employee / self-employed / merchant / NRI). The required documents vary from bank to bank. Below are some lists …

When you get a loan, you must repay it to the lender within a certain period of time. The repayment includes both principal and interest from a predefined number of monthly payments. Simply put, repaying the loan through a series of scheduled payments, commonly known as EMI, that includes both the principal amount outstanding and …

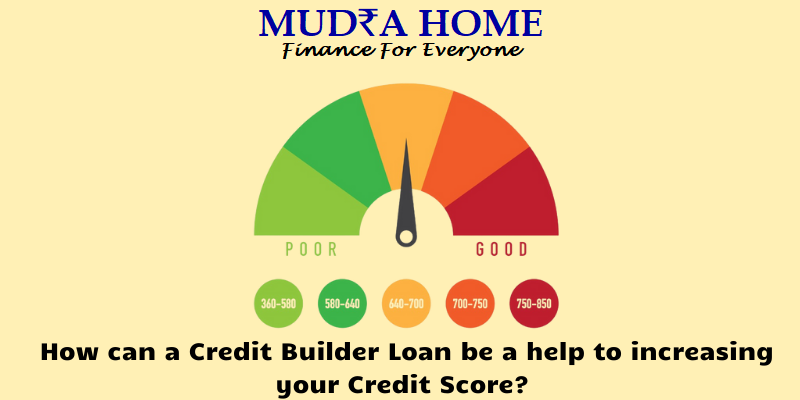

Trying to get credit can be challenging. This is especially true if you have no credit or bad credit and cannot get credit. Your previous payments history is one of the most important parts of your credit history. Failure to obtain permission to borrow will not allow you to improve your score and show that …

While some people go for a cash-only lifestyle, most of us rely on credit to pay for the high cost of living over time. If you’re looking to buy an expensive item like a house or car, start or expand a business, remodel a kitchen, or pay for a college education, you can apply for …