Mutual funds are increasingly accepted by various investors in India because of their lightness and their performance. This financial instrument is suitable for all types of investors, small, medium or large because it can use the Systematic Investment Plan (SIP) to invest in mutual funds of an amount between 500 and an infinite monthly and …

Employee Provident Fund as the name suggests is an account under which a saving contribution is made for a salaried employee on a monthly basis. The said saving amount is deducted from the salary of the employee and is either a fixed amount of Rs. 1800% or 12% of the basic salary. Employee Provident Fund …

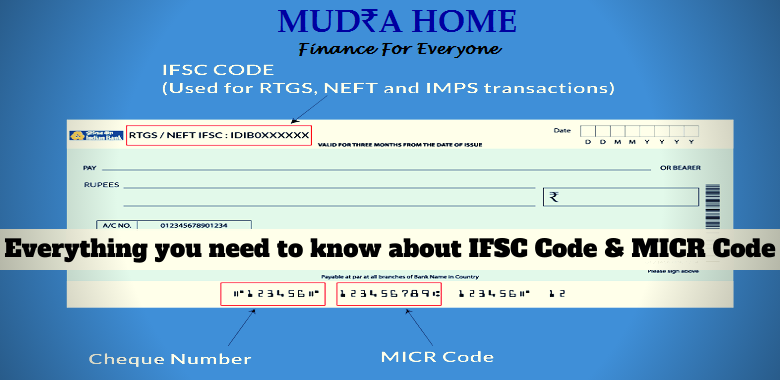

IFSC Code Meaning IFSC code is an eleven-digit alphanumerical number used for online fund transfer through Banks. Generally, the first four digits of the IFSC code are alphabetical representing the name of the Bank, the fifth digit is 0 and the last six digits represent the branch of the Bank identified with a number. The …

A personal loan is an unsecured loan wherein no commodity is mortgaged to the bank as security. These loans are granted for a variety of purposes such as holidays, education, wedding, medical emergency, etc. The interest rates for personal loans are comparatively higher in comparison to any other loans. The interest rate for a personal …

A savings account is a deposit account with a bank or other financial institution where you can store extra money, earn interest, and access it when needed. It is the most basic type of banking instrument used by a person and one of the safest ways to ensure that you can easily access your earned …

Personal loans offered by Yes Bank can be used to cover all financial expenses, including payment of medical bills, weddings, vacation trips, home renovations, etc. An instant personal loan up to 20 lakh rupees can be used by those who meet the eligibility criteria of Yes Bank. In addition, the Yes Bank personal loan can …

Personal loans from Kotak Mahindra Bank are available for applicants who are looking for instant loans for Rs amounts only. 50,000 and as high as Rs. 15 lakh These loans are suitable for financing a variety of financial needs, including home improvement, travel abroad, debt consolidation and medical expenses. Characteristics of the Kotak Mahindra Bank …

The axis bank personal loan doesn’t offer foreclosures, installment fees, quick payments, and versatile end-use. Common uses of an axis personal loan include managing vacation expenses, renovating your home, hosting a dream wedding, and paying for medical emergencies. Axis bank offers personal loans from Rs. 50,000 to Rs. 15 lakh with flexible repayment terms from …