Borrowing a home loan is a commitment for the life and the borrower feels a lot of burden if not planned properly. While planning to borrow a home loan need a scrutiny of your debts and other expenses. The loan amount of the loan may vary from lakhs to crores and the duration can go …

When we think of borrowing a home loan the first thing that comes in our mind is EMI’s. EMI’s are the equal monthly installments that we pay towards the repayment of home loan. The home loan EMI’s are calculated after estimating the capability of bearing the monthly burden. The EMI’s are estimated and calculated for …

In real time situations we can come across the need of finance either for our kids for further studies or we have to arrange funds for the grand dream wedding of our daughter. The first question that comes in our mind is “from where to arrange for the money?” Though there are many options available …

The interest rates on fixed deposits have witnessed a significant increase in recent years due to reverse regime of interest rates and these interest rates are definitely expected to increase in near future. In present scenarios we all try to invest in some or the other way and if you are one of them who …

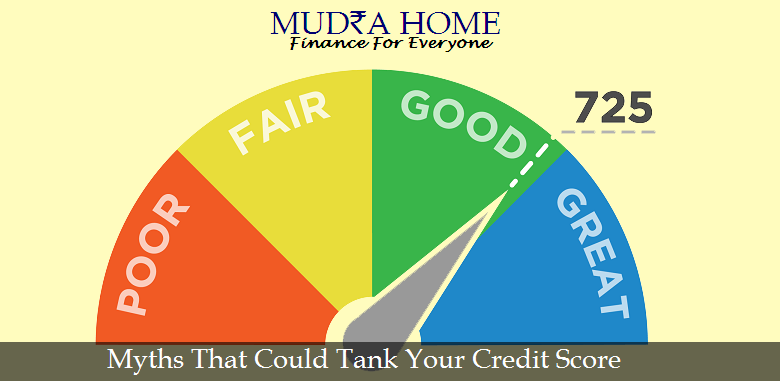

Let’s face it! A Credit score can be mystery as there is a lot of misinformation among us. Yes, it is important to maintain a good credit score but still you cannot believe in everything what you hear. A good intention but a wrong step can push your credit score in a wrong direction too. …

When we borrow a home loan, we don’t know about the future aspects coming in our way. With the fluctuation in economic market that influence the interest rates and the EMI’s we have to think about the necessary aspects so that these fluctuation doesn’t affect our present financial situations. These fluctuations show us a next …

Recently while flipping the pages of my newspaper I saw an article related to financial industry that deals with lending rates. That article was to lighten up our minds with the current changes going on. Many of us don’t know what a little increase in interest rates will bring an impact on our current home …

The huge deposit in Banks due to demonetization has led to reduced lending rates to the lowest in the last 6 to 8 years by the Banks/ NBFC’s. Leading the pack, few nationalized banks has reduced the home loan rates by 50 basis points (bps) to as low as 8.5 per cent (fixed). Even the …